Securing funding for a small business is often a key challenge for entrepreneurs. Whether you’re starting a new venture or scaling an existing one, access to working capital is crucial to business success. In recent years, the rise of online lending platforms has revolutionized the way small businesses secure funding. These platforms offer quick, easy, and flexible financing options that cater to a wide range of business needs. In this article, we’ll explore the top small business loans available online, their benefits, and the factors to consider when applying for funding.

Key Takeaway

- Online small business loans provide fast access to capital with flexible terms, making them an excellent option for entrepreneurs.

- It’s important to research various loan options and understand the terms, fees, and eligibility requirements before applying.

- With proper preparation, you can secure the funding necessary to grow and expand your business.

Understanding Small Business Loans Online

Small business loans online are financing options provided by digital lenders, including peer-to-peer platforms, fintech companies, and traditional financial institutions that have an online presence. Unlike traditional bank loans, which often require lengthy approval processes and significant documentation, online loans are designed to provide faster access to capital with fewer barriers.

Online loans for small businesses can range from short-term loans and lines of credit to longer-term loans and SBA (Small Business Administration) loans. These loans are available for various business purposes, including equipment purchases, inventory restocking, payroll, working capital, or business expansion.

One of the most significant advantages of online loans is the ease of application and quick approval process. Many online lenders use advanced algorithms and data-driven tools to assess creditworthiness, allowing for faster and more efficient decisions compared to traditional banks.

What Are Online Small Business Loans?

Online small business loans are financial products provided by digital lenders such as peer-to-peer platforms, fintech companies, and traditional banks with an online presence. These loans are typically more accessible than traditional loans, offering quicker approval processes and less paperwork. The types of loans available online include term loans, lines of credit, invoice financing, equipment loans, and merchant cash advances, each with its own set of benefits and drawbacks.

In the past, small businesses had to rely on traditional financial institutions, which involved lengthy applications and strict approval criteria. Today, online lenders are changing the game, providing fast and easy access to capital.

Key Benefits of Online Small Business Loans

Before diving into the specific types of loans available, it’s worth understanding why online small business loans have become so popular:

- Speed and Convenience: Online loans are faster to apply for and approve, with some lenders offering funds within 24 hours of approval.

- Less Paperwork: Many online lenders use technology to streamline the approval process, requiring less documentation than traditional banks.

- More Flexible Terms: Online lenders often offer flexible repayment schedules and more lenient credit score requirements than traditional banks.

- Increased Accessibility: Online loans provide access to funding for businesses that may not qualify for traditional loans, including startups and those with poor credit.

Types of Small Business Loans Online

Let’s explore the most popular types of small business loans available online. Each loan type has its own advantages, depending on your business’s needs.

| Loan Type | Best For | Loan Amount | Repayment Terms | Interest Rates |

|---|---|---|---|---|

| Term Loans | Established businesses seeking large amounts of capital for long-term investments | $25,000 to $500,000+ | 1 to 5 years | 6% to 30% APR |

| Lines of Credit | Businesses needing flexible, ongoing access to funds | $10,000 to $250,000 | Revolving (repaid as used) | 7% to 25% APR |

| SBA Loans | Businesses looking for low-interest, long-term loans | $50,000 to $5,000,000 | Up to 25 years | 5% to 10% APR |

| Merchant Cash Advances | Retail businesses with high daily card sales | $5,000 to $250,000 | Daily or weekly repayment | 40% to 350% APR |

| Invoice Financing | Businesses with outstanding invoices needing quick access to cash | 70% to 90% of invoice value | 30 to 90 days | 10% to 20% APR |

| Equipment Financing | Businesses needing to purchase or lease equipment | $10,000 to $500,000 | 2 to 5 years | 6% to 15% APR |

| Crowdfunding | Startups and entrepreneurs looking for investment from a large crowd | $5,000 to $10,000,000 | N/A (campaign-based) | N/A |

| Peer-to-Peer Lending | Businesses that need a straightforward loan from individual investors | $10,000 to $500,000 | 3 to 5 years | 5% to 30% APR |

Detailed Breakdown of Top Online Small Business Loans

Let’s take a closer look at each of the loan options listed above:

Top Small Business Loans Online

Here’s a detailed look at some of the most popular and effective small business loan options available online:

1. Term Loans

Term loans are one of the most common types of business loans offered online. They provide a lump sum of money that is repaid over a set period, typically ranging from one to five years. These loans can be used for a variety of business needs, such as purchasing equipment, expanding operations, or covering working capital.

Pros:

- Fixed interest rates and repayment schedules

- Predictable monthly payments

- Suitable for long-term investments

Cons:

- May require good credit history

- Can have stricter eligibility requirements

Example:

- Funding Circle offers term loans with terms ranging from 6 months to 5 years, with interest rates starting at around 4.99% APR.

2. Lines of Credit

A business line of credit is a revolving form of credit that allows small business owners to borrow funds up to a predetermined limit and repay them over time. Interest is only paid on the amount borrowed, making it a flexible and cost-effective option for businesses with fluctuating cash flow needs.

Pros:

- Flexible borrowing and repayment

- Access to funds whenever needed

- Pay interest only on the drawn amount

Cons:

- Higher interest rates compared to term loans

- May require a strong credit history

Example:

- BlueVine offers a line of credit with credit limits up to $250,000, with rates starting at 4.8% APR.

3. SBA Loans

The U.S. Small Business Administration (SBA) offers several types of loans designed to help small businesses secure funding. These loans are partially guaranteed by the SBA, which reduces the risk for lenders and makes them more accessible for small business owners. SBA loans typically come with lower interest rates and longer repayment terms than traditional bank loans.

Pros:

- Lower interest rates

- Long repayment terms (up to 25 years)

- Lower risk for lenders

Cons:

- Lengthy approval process

- Requires extensive documentation

Example:

- Lendio offers an SBA 7(a) loan program with loan amounts up to $5 million, ideal for long-term investments.

4. Merchant Cash Advances

A merchant cash advance (MCA) is a financing option that allows small businesses to receive an upfront lump sum of cash in exchange for a percentage of future credit card sales or daily revenue. MCAs are typically easy to qualify for, as they are based on your business’s sales volume rather than credit scores.

Pros:

- Quick and easy access to funds

- No collateral required

- Flexible repayment based on sales

Cons:

- High-interest rates

- Short repayment terms

Example:

- Rapid Finance provides merchant cash advances with flexible terms based on daily credit card sales.

5. Invoice Financing

Invoice financing allows small businesses to get immediate cash by selling their unpaid invoices to a lender. The lender advances a percentage of the invoice value, usually between 70-90%, and collects payment from the customer. Once the invoice is paid, the business receives the remaining balance minus the lender’s fee.

Pros:

- Immediate access to funds

- No debt accumulation

- Ideal for businesses with outstanding invoices

Cons:

- Fees can add up

- Only available for businesses with invoicing operations

Example:

- Fundbox offers invoice financing with quick access to up to $150,000, with repayments made in weekly installments.

6. Equipment Financing

If your business requires equipment for day-to-day operations, equipment financing is an excellent option. With this type of loan, the equipment itself serves as collateral, which means you don’t need to provide other assets for security.

Pros:

- Financing specifically for equipment purchases

- Equipment itself acts as collateral

- Low-interest rates and longer repayment terms

Cons:

- Limited to equipment purchases

- May require a down payment

Example:

- Currency provides equipment financing loans with terms ranging from 24 to 60 months and interest rates starting at 7.99%.

7. Crowdfunding

Crowdfunding is a modern alternative to traditional small business loans, where businesses raise capital from a large number of people, typically through online platforms. This method allows businesses to gain financial support from investors who believe in their product or service.

Pros:

- Can generate significant capital

- Involves no debt or equity dilution

- Provides exposure and marketing for your business

Cons:

- Highly competitive

- Time-consuming to launch a campaign

Example:

- Kickstarter and Indiegogo are two of the most popular crowdfunding platforms where small businesses can raise money from backers.

8. Peer-to-Peer (P2P) Lending

Peer-to-peer lending connects small businesses with individual investors who fund their loans. The process is facilitated through online platforms, which act as intermediaries between borrowers and lenders. This model can be a great alternative for businesses that may not qualify for traditional bank loans.

Pros:

- Lower interest rates than traditional lenders

- Flexible terms

- Less stringent eligibility requirements

Cons:

- May require personal guarantees

- Lengthy application process

Example:

- Prosper and LendingClub are two leading platforms that offer peer-to-peer lending options for small businesses.

How to Apply for Small Business Loans Online

Applying for small business loans online has become a convenient and efficient process for many entrepreneurs and small business owners. With the rise of online lenders and digital platforms, securing funding for your business is now faster and easier than ever. Whether you’re looking for working capital, equipment financing, or an expansion loan, online business loans provide quick access to the funds you need.

In this guide, we’ll walk you through the step-by-step process of applying for small business loans online, highlighting what you need to prepare, how to improve your chances of approval, and tips to ensure a smooth application experience.

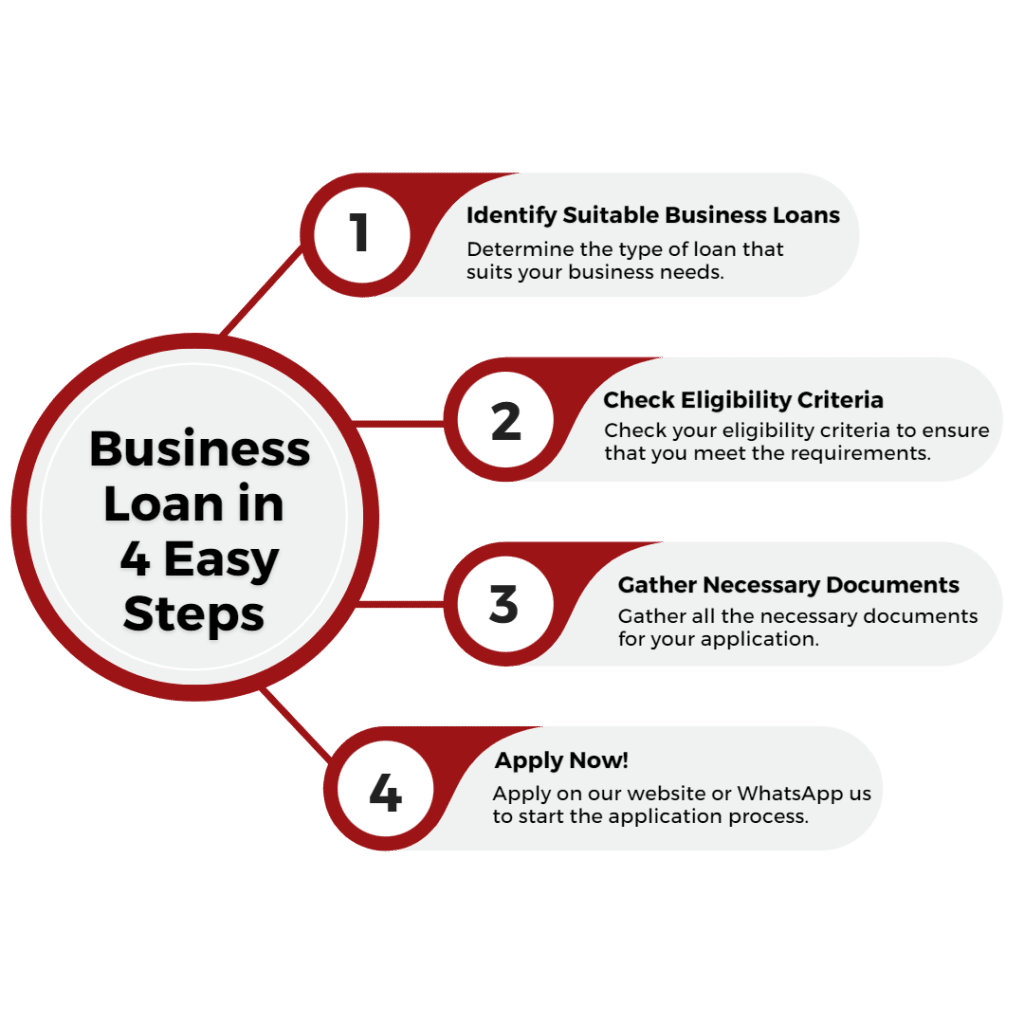

Step-by-Step Process to Apply for Small Business Loans Online

1. Determine the Type of Loan You Need

The first step in applying for an online business loan is understanding the type of financing that best suits your needs. Small business loans come in various forms, such as term loans, lines of credit, SBA loans, equipment financing, merchant cash advances, and invoice financing.

Each type of loan serves a different purpose. For instance:

- Term Loans: Best for larger, long-term investments or expansion.

- Lines of Credit: Ideal for businesses that need flexible access to cash on a revolving basis.

- Equipment Financing: If you need to buy or lease equipment for your business.

- Invoice Financing: Suitable for businesses with unpaid invoices looking to free up cash flow.

Consider your business’s financial needs and select the type of loan that best matches your situation.

2. Research Online Lenders

Once you’ve determined the type of loan, the next step is researching online lenders. Unlike traditional banks, online lenders provide quicker approval processes and often have more lenient eligibility requirements.

Here are some popular online lenders for small business loans:

- Kabbage: Known for fast lines of credit with a simple online application.

- BlueVine: Offers lines of credit and invoice factoring with minimal paperwork.

- Funding Circle: Specializes in term loans for established businesses.

- Lendio: A loan marketplace that connects businesses with multiple lenders, offering a variety of financing options.

- OnDeck: Provides short-term loans and lines of credit with fast approval times.

Make sure to compare the loan terms, interest rates, and repayment schedules offered by different lenders to ensure that you’re getting the best deal for your business.

3. Prepare Your Documents

When applying for a small business loan online, lenders typically require certain documentation to assess your eligibility. While the paperwork is generally less burdensome than traditional loans, you will still need to provide some key documents. These may include:

- Business Plan: A well-written business plan detailing your business’s goals, target market, financial projections, and how you intend to use the loan funds.

- Tax Returns: Personal and business tax returns for the past 1–3 years, which help the lender assess your financial history.

- Financial Statements: These may include balance sheets, profit and loss statements, and cash flow statements.

- Bank Statements: Recent business bank statements to show the lender your cash flow and financial stability.

- Legal Documents: Business licenses, ownership documents, and any legal agreements related to your business.

- Credit History: While some online lenders have more flexible requirements, they may still check your credit history to determine your loan eligibility.

Make sure all your documents are organized and up-to-date before starting the application process.

4. Fill Out the Online Application

After selecting your lender and gathering the necessary documents, the next step is to fill out the online application. The application process is typically simple and can be completed on the lender’s website in just a few minutes.

The online application will ask for basic information about your business, including:

- Business Name and Legal Structure: Provide details about your business’s legal structure (sole proprietorship, LLC, corporation, etc.) and its registered name.

- Business Address and Contact Info: You’ll need to supply the physical address, phone number, and email address of your business.

- Revenue Information: You may need to provide information about your annual revenue, monthly income, and other financial figures.

- Loan Amount: Specify how much money you’re requesting and how you plan to use the funds.

Make sure the information you provide is accurate and truthful to avoid delays in processing your application.

5. Submit Your Application

Once your application is complete and all supporting documents have been uploaded, submit your application to the lender. Some lenders may allow you to track the status of your application through their online platform.

Many online lenders offer automated decision-making, which means you’ll receive an immediate response or decision on your loan application. In some cases, it may take a few days for the lender to review your application and confirm approval.

6. Review Loan Offer

If approved, the lender will send you a loan offer detailing the terms and conditions of the loan. This offer will include:

- Loan Amount: The amount of funding the lender is willing to offer.

- Interest Rate: The rate at which the lender will charge for borrowing the money.

- Repayment Terms: The length of the loan and how often payments are due (daily, weekly, or monthly).

- Fees: Any origination fees, prepayment penalties, or other costs associated with the loan.

Take the time to review the offer carefully. Don’t be afraid to ask the lender for clarification if you don’t understand any terms. Compare offers from different lenders to find the best one for your business.

7. Accept the Loan and Receive Funds

Once you’ve reviewed the loan offer and are satisfied with the terms, you can accept the loan. After acceptance, the lender will disburse the funds to your business account, typically within 24–48 hours, depending on the lender.

Ensure you know the repayment schedule and manage your cash flow accordingly to make timely payments. Failure to repay the loan as agreed can negatively impact your credit score and your business’s financial health.

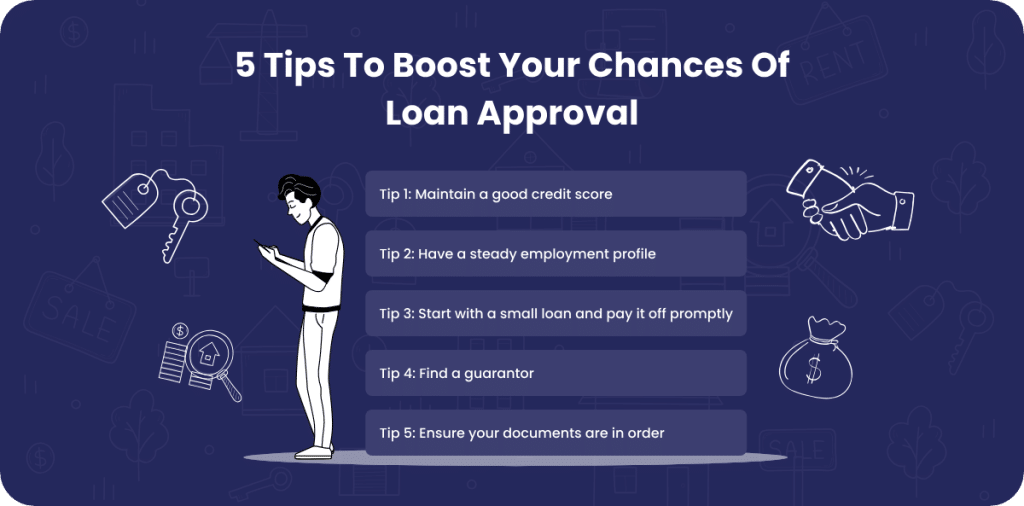

Tips for Increasing Your Chances of Approval

While applying for an online small business loan can be simpler than going through a traditional bank, it’s still important to put your best foot forward. Here are some tips to improve your chances of getting approved:

- Maintain Good Credit: A strong credit score can improve your chances of securing favorable loan terms. Work on paying off outstanding debts and avoid late payments.

- Have a Solid Business Plan: Lenders want to see that you have a clear strategy for growing your business and using the loan funds wisely.

- Show Consistent Cash Flow: Stable cash flow is essential for loan repayment. Lenders want to see that your business can handle the loan payments without compromising daily operations.

- Diversify Your Loan Options: If you’re unable to secure funding from one lender, don’t hesitate to apply with others. Some lenders specialize in working with specific industries or business types.

- Provide Clear Financial Records: Ensure your business financial records, such as tax returns and bank statements, are up-to-date and accurate to increase your credibility with lenders.

Also Read: Unsecured Loans For Small Business: Fast And Flexible Financing Solutions

Conclusion

Online small business loans have become an essential tool for entrepreneurs seeking fast and flexible financing. Whether you need funding for equipment, working capital, or business expansion, online lenders provide a variety of loan types to suit different needs. While the application process is straightforward, it’s important to understand your business’s needs, compare lenders, and ensure you meet the eligibility requirements to secure the best terms.

FAQs

What is the best type of loan for a small business?

The best type of loan depends on your business’s needs. For long-term investments, a term loan or SBA loan may be ideal. If you need flexible working capital, consider a line of credit.

How fast can I get an online small business loan?

Many online lenders offer approval within 24 hours and fund loans within a few days, making them much quicker than traditional bank loans.

Do I need collateral for an online small business loan?

Unsecured loans do not require collateral, but some types of loans, such as merchant cash advances or equipment financing, may require assets as security.

What are the eligibility requirements for online small business loans?

Eligibility requirements vary by lender, but generally, you’ll need to have a certain level of revenue, good credit history, and a few years in business.

What is the average interest rate on online small business loans?

Interest rates can vary depending on the loan type and lender, but typically range from 5% to 30%.

Can I apply for an online loan if my business is new?

Yes, some online lenders specialize in providing loans to startups and businesses with limited credit history.

How do I know if I qualify for a loan?

Lenders assess factors like credit score, business revenue, and time in business to determine your eligibility. It’s essential to maintain strong financial health to increase your chances of approval.