In today’s fast-paced world, securing financial support has become easier than ever, thanks to online personal loan platforms. Whether you’re facing a medical emergency, planning a wedding, consolidating debt, or simply need extra cash, online personal loans provide quick and hassle-free solutions.

In this article, we’ll explore the top 10 personal loan providers online, their features, eligibility criteria, and how they can meet your financial needs efficiently. Let’s dive in!

Key Takeaway

Online personal loans are an excellent choice for quick financial assistance. Always compare lenders based on interest rates, fees, and repayment terms to secure the best deal. Platforms like SoFi and LightStream offer competitive rates for top-tier borrowers, while Avant and Upgrade are ideal for those with lower credit scores.

What Are Online Personal Loans?

Online personal loans are unsecured loans offered by financial institutions or digital lenders through online platforms. Unlike traditional loans that require physical visits to banks or credit unions, online personal loans allow borrowers to apply, get approved, and receive funds entirely through digital channels. These loans are designed to meet various personal financial needs, such as consolidating debt, covering medical expenses, funding home improvements, or managing unexpected emergencies.

Key Features of Online Personal Loans

- Unsecured Nature:

- Most online personal loans do not require collateral, making them accessible to borrowers who may not own substantial assets.

- Digital Process:

- Applications, approvals, and fund disbursements are completed online, eliminating the need for in-person interactions.

- Flexible Loan Amounts and Terms:

- Borrowers can typically choose loan amounts ranging from $1,000 to $100,000, depending on the lender. Repayment terms may vary from 12 months to several years.

- Quick Disbursal:

- Many online lenders offer same-day or next-day fund transfers, ideal for emergencies.

- Transparent Pricing:

- Online lenders often provide clear details about interest rates, fees, and repayment schedules upfront.

How Do Online Personal Loans Work?

- Application Process:

- Borrowers fill out an online application form, providing details such as income, employment status, credit score, and loan requirements.

- Approval Criteria:

- Lenders evaluate the application based on the borrower’s creditworthiness, income stability, and debt-to-income ratio. Some lenders, like Upstart, also consider non-traditional factors such as education and job history.

- Loan Approval and Offer:

- If approved, the lender presents the borrower with an offer outlining the loan amount, interest rate, fees, and repayment terms.

- Acceptance and Fund Disbursement:

- Borrowers review the offer, accept the terms, and receive the funds, usually within 1-3 business days or even sooner with some platforms.

- Repayment:

- Borrowers repay the loan in monthly installments, which include the principal and interest. Most lenders allow automatic payments for convenience.

Advantages of Online Personal Loans

- Speed: Instant pre-approvals and quick fund disbursements.

- Convenience: Apply anytime, anywhere, with just a smartphone or computer.

- No Collateral Needed: Borrowers don’t need to pledge assets.

- Competitive Rates: Online platforms often offer competitive interest rates due to reduced operational costs.

- Customizable Terms: Borrowers can choose loan terms that best suit their financial situation.

Disadvantages to Consider

- Higher Rates for Poor Credit: Borrowers with low credit scores may face higher interest rates.

- Potential Scams: Some online platforms may not be legitimate; thorough research is essential.

- No In-Person Support: Lack of face-to-face interaction can be challenging for those who prefer traditional customer service.

Who Can Benefit from Online Personal Loans

- Individuals with Good Credit: Access lower interest rates and higher loan amounts.

- Those Needing Fast Cash: Ideal for emergencies due to quick disbursal times.

- Debt Consolidators: Simplify multiple debts into a single payment with a personal loan.

- People Without Collateral: Since these loans are unsecured, no assets are required.

Example Scenario

Situation: Maria needs $10,000 for an unexpected medical expense.

- She applies for an online personal loan with SoFi and gets approved within 24 hours due to her good credit score.

- The funds are disbursed to her account the next day, allowing her to cover the medical bills promptly.

Detailed Review of Top Online Personal Loans

Online personal loans have gained immense popularity due to their convenience and speed. Here’s a detailed review of some of the best online personal loans available, highlighting their key features, benefits, and potential drawbacks.

1. SoFi Personal Loans

SoFi is renowned for its competitive interest rates and excellent member perks.

- Loan Amount: $5,000 – $100,000

- APR: 7.99% – 23.43% (with autopay discounts)

- Loan Term: 24 to 84 months

- Key Features:

- No origination fees or prepayment penalties.

- Unemployment protection allows payment pauses during job loss.

- Member benefits, including career coaching and financial planning.

- Best For: Borrowers with good to excellent credit scores looking for flexible repayment terms.

2. LightStream

LightStream, a division of Truist Bank, specializes in loans for those with excellent credit.

- Loan Amount: $5,000 – $100,000

- APR: 7.49% – 25.49%

- Loan Term: 24 to 144 months (varies by loan purpose)

- Key Features:

- Rate Beat Program: LightStream will beat competitor rates by 0.1%.

- No fees, including origination or late fees.

- Quick funding, sometimes on the same business day.

- Best For: Borrowers with excellent credit and those needing large loan amounts for specific purposes like home renovations.

3. Upstart

Upstart is ideal for borrowers with limited credit history or lower credit scores.

- Loan Amount: $1,000 – $50,000

- APR: 6.50% – 35.99%

- Loan Term: 36 to 60 months

- Key Features:

- AI-driven approval process considers factors like education and employment.

- Quick disbursement within one business day of approval.

- Transparent fee structure.

- Best For: Individuals with non-traditional credit profiles or recent graduates building their credit.

4. Marcus by Goldman Sachs

Marcus offers personal loans with no hidden fees.

- Loan Amount: $3,500 – $40,000

- APR: 6.99% – 24.99%

- Loan Term: 36 to 72 months

- Key Features:

- No fees for origination, late payments, or prepayment.

- On-time payment rewards: Lower interest rate after 12 consecutive payments.

- Fixed interest rates for predictable monthly payments.

- Best For: Borrowers looking for a straightforward loan with no hidden costs.

5. Avant

Avant caters to individuals with fair credit scores.

- Loan Amount: $2,000 – $35,000

- APR: 9.95% – 35.99%

- Loan Term: 12 to 60 months

- Key Features:

- Accepts lower credit scores (580+).

- Offers secured and unsecured loan options.

- Funds disbursed within 1-2 business days.

- Best For: Borrowers with less-than-perfect credit or those rebuilding their financial standing.

6. Discover Personal Loans

Discover offers versatile personal loans with no hidden fees.

- Loan Amount: $2,500 – $35,000

- APR: 6.99% – 24.99%

- Loan Term: 36 to 84 months

- Key Features:

- No origination fees or prepayment penalties.

- 30-day money-back guarantee if you change your mind.

- Fast approval process with funds in as little as one business day.

- Best For: Borrowers who value transparency and flexible repayment options.

7. LendingClub

LendingClub offers peer-to-peer lending services.

- Loan Amount: $1,000 – $40,000

- APR: 8.05% – 36.00%

- Loan Term: 36 to 60 months

- Key Features:

- Joint loan option for co-borrowers.

- Soft credit pull for rate checking.

- Easy-to-use online platform.

- Best For: Borrowers seeking a joint loan option and competitive rates.

8. Best Egg

Best Egg provides low-interest loans for debt consolidation.

- Loan Amount: $2,000 – $50,000

- APR: 8.99% – 35.99%

- Loan Term: 36 to 60 months

- Key Features:

- Quick disbursement: Funds are often available the next day.

- Customizable loan options for different financial needs.

- Focuses on debt consolidation and credit card refinancing.

- Best For: Borrowers with a strong repayment history looking for debt consolidation.

9. Payoff

Payoff specializes in loans for credit card debt reduction.

- Loan Amount: $5,000 – $40,000

- APR: 7.99% – 29.99%

- Loan Term: 24 to 60 months

- Key Features:

- Tailored for credit card debt consolidation.

- No late fees, prepayment penalties, or annual fees.

- Includes free FICO score updates.

- Best For: Individuals focused on reducing their credit card debt.

10. Upgrade

Upgrade combines personal loans with budgeting tools.

- Loan Amount: $1,000 – $50,000

- APR: 8.49% – 35.99%

- Loan Term: 24 to 84 months

- Key Features:

- Includes free credit monitoring and financial tools.

- Offers secured and unsecured loans.

- Funds disbursed within one business day of approval.

- Best For: Borrowers seeking additional financial planning tools alongside a loan.

Comparison Table: Top Online Personal Loans

| Lender | Loan Amount | Interest Rate (APR) | Funding Time | Best For |

|---|---|---|---|---|

| SoFi | $5,000 – $100,000 | 5.99% – 18.00% | 1-2 business days | High-income borrowers |

| Upstart | $1,000 – $50,000 | 6.50% – 35.99% | Same-day | Borrowers with limited credit history |

| LightStream | $5,000 – $100,000 | 4.99% – 20.49% | Same-day | Excellent credit borrowers |

| LendingClub | $1,000 – $40,000 | 7.04% – 35.89% | 2-3 business days | Peer-to-peer lending fans |

| Discover | $2,500 – $35,000 | 5.99% – 24.99% | 1-2 business days | No-fee personal loans |

| Avant | $2,000 – $35,000 | 9.95% – 35.99% | Next-day | Fair credit borrowers |

| Marcus by Goldman Sachs | $3,500 – $40,000 | 6.99% – 24.99% | 1-3 business days | Fee-free loans |

| Rocket Loans | $2,000 – $45,000 | 5.97% – 29.99% | Same-day | Emergency funding |

| Earnest | $1,000 – $50,000 | 6.99% – 18.24% | 1-2 business days | Customized repayment options |

| Upgrade | $1,000 – $50,000 | 8.49% – 35.99% | 1-2 business days | Rebuilding credit |

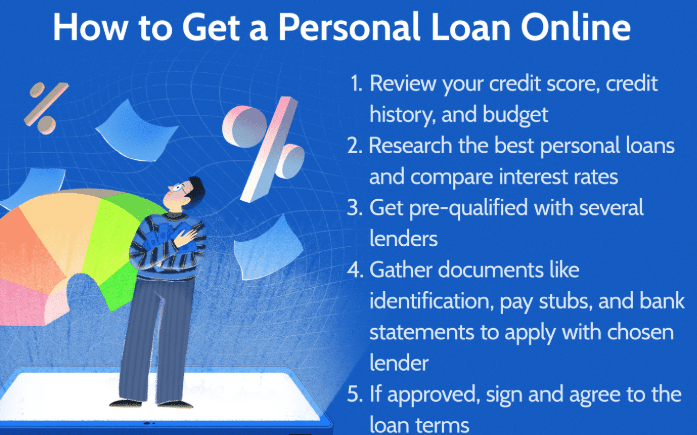

How to Apply for an Online Personal Loan

Applying for an online personal loan is a straightforward process that can often be completed from the comfort of your home. Here’s a step-by-step guide to help you navigate the application process efficiently.

Step 1: Assess Your Financial Needs

Before applying for a personal loan, clearly outline your financial requirements.

- Determine the Loan Amount: Calculate how much money you need and avoid borrowing more than necessary.

- Evaluate Your Repayment Capacity: Check your income, monthly expenses, and credit obligations to ensure you can comfortably repay the loan.

Step 2: Check Your Credit Score

Your credit score is a key factor lenders consider when approving personal loans.

- Why It Matters: A higher credit score can help you secure lower interest rates and better loan terms.

- How to Check: Use free tools like Credit Karma or your bank’s credit report services.

- Improvement Tips: If your credit score is low, take steps to improve it, such as paying down existing debts or correcting errors in your credit report.

Step 3: Compare Lenders

Research and compare different online lenders to find the best loan for your needs.

| Comparison Factors | What to Look For |

|---|---|

| Loan Amounts | Ensure the lender offers the amount you need. |

| Interest Rates (APR) | Compare rates to find the most affordable option. |

| Loan Terms | Check repayment periods and flexibility. |

| Fees | Look for origination fees, late payment fees, or prepayment penalties. |

| Eligibility Requirements | Ensure you meet the lender’s minimum credit score and income criteria. |

Step 4: Gather Required Documents

Most online lenders require specific documentation to process your application.

- Common Documents Needed:

- Government-issued ID (e.g., driver’s license or passport)

- Proof of income (e.g., pay stubs, tax returns, or bank statements)

- Employment verification

- Proof of residence (e.g., utility bills or lease agreement)

- Social Security Number

Step 5: Pre-Qualify for Loans

Many lenders offer a pre-qualification option that allows you to see potential loan offers without affecting your credit score.

- How It Works: The lender performs a soft credit check to provide estimated loan terms.

- Why Pre-Qualify: It helps you compare offers and select the most suitable option without risking a hard inquiry.

Step 6: Submit Your Application

Once you’ve chosen a lender, complete the application process.

- Online Application: Most lenders have user-friendly online portals or mobile apps where you can apply.

- Provide Accurate Information: Double-check your details to avoid delays or rejection.

- Attach Documents: Upload the required documents as per the lender’s instructions.

Step 7: Wait for Approval

After submitting your application, the lender reviews your details and performs a credit check.

- Approval Time: Approval times vary; some lenders offer instant decisions, while others take a few business days.

- Conditional Approval: You might receive conditional approval requiring additional information or documents.

Step 8: Review Loan Terms

If your loan is approved, carefully review the loan terms before accepting.

- Key Points to Check:

- Interest rate (APR)

- Repayment schedule

- Fees (e.g., origination fees or late payment penalties)

- Loan term length

- Clarify Questions: Contact the lender if you have any doubts about the terms.

Step 9: Accept the Loan Offer

Once you’re satisfied with the terms, sign the loan agreement digitally.

- Electronic Signature: Most lenders allow you to sign the agreement online for convenience.

- Funds Disbursement: After signing, funds are typically deposited into your bank account within 1-3 business days. Some lenders offer same-day funding.

Step 10: Repay Your Loan

Repayment begins as per the agreed-upon schedule.

- Set Up Auto-Payments: Automate payments to avoid late fees and maintain a good credit score.

- Early Repayment: If your lender allows it without penalties, consider paying off your loan early to save on interest.

Example Timeline for Applying

Step | Time Needed |

|---|---|

| Research and Compare | 1-2 days |

| Gather Documents | 1 day |

| Pre-Qualify | Instant or within minutes |

| Submit Application | 20-30 minutes |

| Approval | Instant to 5 business days |

| Disbursement of Funds | 1-3 business days (sometimes same-day) |

How to Apply for an Online Personal Loan: Comprehensive Guide

Applying for an online personal loan has become a popular choice due to its convenience, speed, and flexibility. However, the process can vary depending on the lender and your financial circumstances. Here’s a detailed breakdown to help you navigate this journey.

- Understand the Basics of Online Personal Loans

Before diving into the application process, it’s crucial to understand what an online personal loan entails:

Definition: A personal loan offered through online platforms without visiting a bank or credit union.

Uses: Covering emergencies, debt consolidation, home improvements, weddings, or medical expenses.

Key Features: Fixed interest rates, pre-set repayment terms, and diverse loan amounts.

- Assess Your Financial Goals and Requirements

Understanding your financial needs ensures you borrow the right amount without overextending yourself.

Set a Clear Purpose: Determine why you need the loan—this could affect lender decisions, especially for niche loans like medical or educational purposes.

Know Your Budget: Use a loan calculator to understand monthly payments and ensure it fits within your financial capabilities.

Example:

Suppose you need $10,000 for debt consolidation. Using a loan calculator, you find that with a 10% interest rate over 3 years, your monthly payment would be around $323.

- Research and Shortlist Lenders

Selecting the right lender is crucial to getting the best terms and a hassle-free experience.

Comparison Chart Example:

Lender Name Loan Amount Range APR Repayment Terms Processing Speed

Lender A $1,000 – $50,000 6.99% – 19.99% 12 – 60 months Same-day funding

Lender B $5,000 – $40,000 7.99% – 24.99% 24 – 72 months 1-2 business days

Lender C $500 – $35,000 5.99% – 29.99% 6 – 48 months Same-day funding

Pro Tip: Use online aggregators or review websites to compare multiple lenders in one place.

- Check Eligibility Requirements

Online lenders typically specify eligibility criteria on their websites. Some common factors include:

Credit Score: Most lenders prefer a minimum score of 600, although options exist for those with lower scores.

Income Level: You may need to provide proof of steady income through pay stubs, tax returns, or bank statements.

Debt-to-Income Ratio (DTI): A DTI below 40% is ideal for many lenders.

Residency and Age: You must be a legal resident and at least 18 years old.

- Gather Required Documentation

Having all the necessary documents ready can expedite the application process.

Typical Documents Include:

Government-issued ID: Driver’s license, passport, or other valid ID.

Proof of Income: Recent pay stubs, bank statements, or tax returns.

Proof of Employment: A letter from your employer or employment contract.

Proof of Residence: Utility bills or lease agreements with your name and address.

Social Security Number (SSN): Required for credit checks.

- Pre-Qualify for Loan Offers

Many online lenders offer a pre-qualification process that provides potential loan terms without affecting your credit score.

Soft Credit Check: Unlike hard inquiries, this doesn’t impact your credit score.

Why Pre-Qualify: Compare interest rates, loan amounts, and repayment terms before committing to one lender.

- Submit Your Application Online

Once you’ve selected a lender and pre-qualified, proceed with the full application.

Step-by-Step Online Application:

Create an Account: Register on the lender’s website or app.

Fill Out the Form: Provide personal details, financial information, and loan requirements.

Upload Documents: Ensure documents are legible and up to date.

Submit Application: Double-check all information to avoid errors that could delay approval.

- Understand the Approval Process

After submitting your application, the lender evaluates it based on your creditworthiness and provided documents.

Instant Approval: Many lenders use automated systems for quick decisions.

Manual Review: For complex cases, human verification may take 1-3 business days.

Conditional Offers: Sometimes, lenders may request additional documents or clarification.

- Review and Accept Loan Terms

Once approved, review the loan agreement carefully.

Key Elements to Check:

Annual Percentage Rate (APR): Ensure it aligns with what was initially quoted.

Repayment Terms: Understand the loan duration and monthly payment amount.

Additional Fees: Look for origination fees, late payment penalties, or prepayment charges.

Example:

If your loan includes a 3% origination fee on a $10,000 loan, you’ll pay $300 upfront.

- Receive Funds

Once you accept the terms, the lender disburses the funds directly to your bank account.

Typical Timeline: Funds are deposited within 24 hours to 3 business days.

Emergency Loans: Some lenders offer same-day or next-day funding for urgent needs.

- Manage Repayments

Repayment begins as per the loan agreement.

Conclusion

Applying for an online personal loan is an efficient process if you follow the correct steps and prepare in advance. Understanding your financial needs, comparing lenders, and maintaining accurate documentation can simplify the process and improve your chances of approval.

FAQs

1. What is an online personal loan?

An online personal loan is a type of unsecured loan that can be applied for, approved, and disbursed entirely through digital platforms. Borrowers use these loans for purposes such as consolidating debt, covering emergencies, or funding major expenses.

2. How long does it take to get approved for an online personal loan?

The approval process varies by lender. Many online lenders offer instant or same-day approval, while others may take 1-3 business days for manual reviews.

3. What documents are required for an online personal loan application?

Typical documentation includes:

- Government-issued ID (e.g., passport or driver’s license)

- Proof of income (e.g., pay stubs or bank statements)

- Proof of employment

- Proof of residence (e.g., utility bills)

- Social Security Number (SSN)

4. Can I get an online personal loan with a bad credit score?

Yes, many lenders cater to individuals with poor or fair credit scores. However, such loans may have higher interest rates and stricter terms. Consider exploring lenders specializing in bad credit loans.

5. What factors impact the interest rate on an online personal loan?

Key factors include:

- Your credit score and history

- Debt-to-income (DTI) ratio

- Loan amount and term length

- Lender policies

6. Are there any fees associated with online personal loans?

Yes, some lenders charge additional fees, such as:

- Origination Fees: A percentage of the loan amount, deducted upfront.

- Late Payment Fees: Charged if you miss a payment.

- Prepayment Penalties: Incurred for paying off the loan early (though not all lenders impose this).

7. How can I ensure my personal and financial information is safe?

To protect your data:

- Apply through reputable and secure lender websites.

- Look for HTTPS in the URL and ensure the site is SSL-encrypted.

- Avoid sharing sensitive information over email or phone unless it’s a verified channel.