In today’s fast-paced world, financial emergencies can strike at any time. Whether you need to cover an unexpected medical bill, consolidate high-interest credit card debt, or fund home improvements, online personal loans provide a convenient and efficient way to secure the funds you need. This article will explore what online personal loans are, how they work, their benefits, and the steps involved in applying for one. We’ll also address common questions and provide key takeaways to help you make an informed decision.

Key Takeaways

- Convenience: Online personal loans provide a fast, secure, and easy way to get the funds you need.

- Eligibility: Lenders look at your credit score, income, and other factors when approving your loan application.

- Repayment Terms: It’s crucial to understand your loan terms, including the interest rate, fees, and repayment schedule.

- Compare Lenders: Shop around to find the best rates and terms, especially if you have a lower credit score.

- Safe Borrowing: Always apply through reputable, secure websites to protect your personal information.

What Are Online Personal Loans?

Online personal loans are a type of unsecured loan that you can apply for and receive entirely through digital platforms. Unlike traditional loans that require you to visit a physical bank or financial institution, online personal loans allow borrowers to complete the entire application process, from submission to approval and disbursement, online.

These loans are typically offered by online lenders, traditional banks, or credit unions that have digital platforms. The primary appeal of online personal loans is their convenience, speed, and simplicity. Borrowers can access funds quickly without the need to go through the lengthy and paperwork-intensive process often associated with traditional lending.

Key Features of Online Personal Loans

Unsecured Loans: Most online personal loans are unsecured, meaning they do not require collateral. Lenders approve these loans based on factors such as creditworthiness, income, and financial history.

Loan Amount: Depending on the lender, you can borrow anywhere from a few hundred to tens of thousands of dollars. The loan amount depends on factors like your credit score, income level, and the lender’s policies.

Fixed Interest Rates: Many online lenders offer fixed interest rates, which means your interest rate stays the same throughout the life of the loan. This helps borrowers plan for their monthly payments and avoid surprises.

Flexible Loan Terms: Online personal loans come with a range of repayment terms, from a few months to several years. The loan term you choose will impact your monthly payments and total interest paid over time.

Quick Approval and Disbursement: One of the main benefits of online personal loans is the speed of approval. Many lenders provide instant or same-day approval, and funds can often be disbursed within 24 hours.

Minimal Documentation: The application process is generally straightforward, requiring minimal documentation compared to traditional loans. Most online lenders only ask for proof of identity, income, and residence.

How Do Online Personal Loans Work?

The process of obtaining an online personal loan is simple and can be completed in a few steps:

Research and Compare Lenders: Start by researching different online lenders. Compare interest rates, loan amounts, terms, and fees to find the best option for your needs.

Pre-Qualification: Some lenders offer a pre-qualification process where you can check your eligibility without affecting your credit score. During this step, lenders will look at your financial situation, including your credit score and income, to give you an idea of the loan amount and interest rate you might be offered.

Complete the Application: After pre-qualification, you can proceed to complete the full loan application. This may require providing documents such as proof of income, identity, and residence. Some lenders may also ask for your Social Security Number or a tax return for verification.

Loan Approval: Once your application is submitted, the lender will review your information and decide whether to approve or deny your loan. If approved, they will provide you with the loan offer, which includes details like the interest rate, loan amount, fees, and repayment terms.

Accept the Loan Offer: If you’re satisfied with the terms, you can accept the loan offer. The lender will then disburse the funds to your bank account, often within a day.

Repayment: Repayment of online personal loans is typically made in fixed monthly installments. Depending on the lender, you may have the option to set up automatic payments for convenience.

Advantages of Online Personal Loans

Convenience: You can apply for a loan from the comfort of your home at any time, without needing to visit a bank branch or meet a loan officer in person.

Speed: Online lenders often provide quick approval, with funds disbursed in as little as one business day. This is especially helpful in emergencies when you need money fast.

Competitive Rates: Some online lenders offer lower interest rates than traditional banks, especially if you have a good credit score.

No Collateral: Most online personal loans are unsecured, so you don’t need to pledge an asset like your car or home to qualify.

Transparent Terms: Reputable online lenders provide clear loan terms upfront, so you know exactly what you’re signing up for without any hidden fees or surprises.

Disadvantages of Online Personal Loans

Higher Interest Rates for Bad Credit: If your credit score is low, you may still qualify for an online personal loan, but the interest rate could be significantly higher. Lenders use your credit score to assess your risk as a borrower, and a lower score means more risk for the lender.

Fees: Some online lenders charge fees, such as origination fees, prepayment penalties, or late fees. It’s important to understand all the fees before you accept a loan offer.

Limited Personal Interaction: For some borrowers, the lack of face-to-face interaction with a loan officer can be a downside. If you have complex financial questions or concerns, it can feel less personal than traditional lending.

Scams: While many online lenders are legitimate, the internet also harbors fraudulent schemes. Always verify that the lender you’re considering is reputable and check for secure connections when sharing personal information.

When Should You Consider an Online Personal Loan?

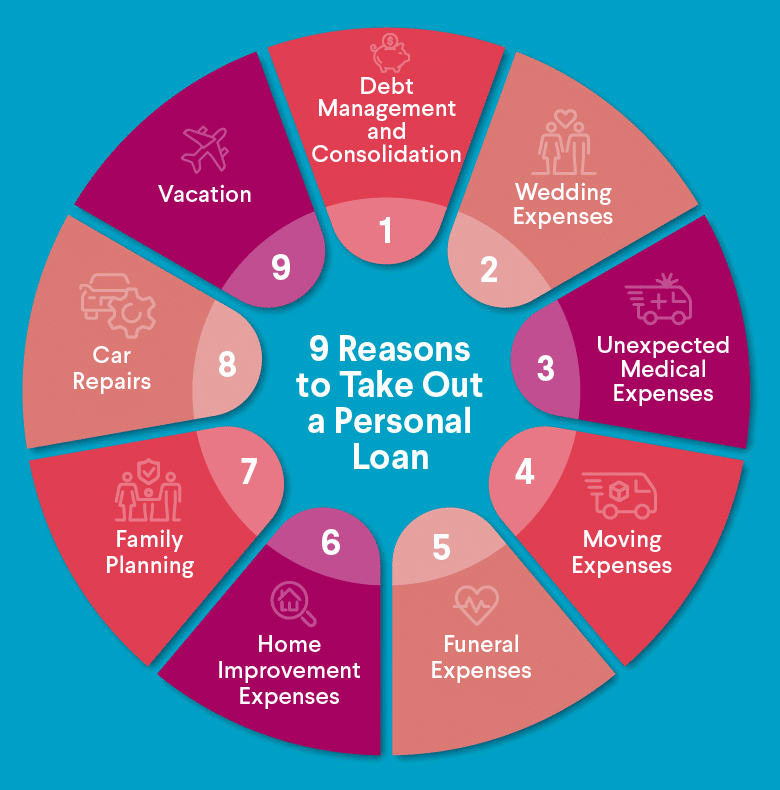

Online personal loans can be a great solution in various situations, including:

Debt Consolidation: If you have high-interest credit card debt or other loans, consolidating them into a single online personal loan with a lower interest rate can help you save money and simplify payments.

Emergency Expenses: Unexpected expenses, like medical bills or car repairs, can be covered quickly with an online personal loan.

Home Improvements: If you need to fund a renovation or make repairs to your home, an online personal loan can help you get the necessary funds without having to apply for a home equity loan or line of credit.

Major Life Events: Personal loans can also be used to fund life events such as weddings, vacations, or educational expenses.

Refinancing Debt: If you have existing loans with high-interest rates, you can refinance them with a more affordable online personal loan.

Types of Online Personal Loans

Online personal loans come in various forms, each designed to meet the unique financial needs of different borrowers. Understanding the different types of online personal loans can help you choose the one that best fits your situation. Here’s an overview of the common types of online personal loans:

1. Unsecured Personal Loans

What is it?

An unsecured personal loan is a type of loan that does not require any collateral (such as your car or home). These loans are typically approved based on your creditworthiness, income, and other financial factors.

Why Consider It?

- No need to pledge valuable assets.

- Ideal for borrowers who don’t want to risk their property or valuables.

- Convenient and fast, as they require minimal documentation.

Common Uses:

- Debt consolidation

- Emergency expenses

- Medical bills

- Home improvements

Advantages:

- Quick approval process

- Flexible loan amounts and repayment terms

- Lower risk since no collateral is involved

Disadvantages:

- Higher interest rates for borrowers with lower credit scores

- May require good to excellent credit to qualify for favorable terms

2. Secured Personal Loans

What is it?

A secured personal loan requires the borrower to pledge an asset (such as a car, savings account, or home) as collateral. In case of default, the lender can seize the asset to recover the loan amount.

Why Consider It?

- Borrowers with low credit scores may find it easier to qualify.

- Often comes with lower interest rates compared to unsecured loans.

Common Uses:

- Large purchases

- Debt consolidation

- Home improvements

Advantages:

- Lower interest rates compared to unsecured loans

- Easier approval for those with less-than-perfect credit

Disadvantages:

- Risk of losing the collateral if the loan is not repaid

- Often longer approval processes as the lender assesses the value of collateral

3. Debt Consolidation Loans

What is it?

A debt consolidation loan is specifically designed to combine multiple high-interest debts (e.g., credit card balances, personal loans, medical bills) into a single loan with a potentially lower interest rate.

Why Consider It?

- Simplifies your finances by consolidating several payments into one.

- Could save money on interest and help reduce debt faster.

Common Uses:

- Combining multiple credit card debts

- Paying off personal loans

- Consolidating medical bills

Advantages:

- Simplified repayment process

- Potential for lower interest rates

- May improve credit score by reducing the number of accounts with high balances

Disadvantages:

- May require good credit to qualify for favorable rates

- If you continue to accrue new debt, you might find yourself in a worse financial situation

4. Peer-to-Peer (P2P) Loans

What is it?

Peer-to-peer loans are loans that are provided by individual investors rather than traditional financial institutions. Online P2P platforms connect borrowers with these investors, offering an alternative to traditional lending.

Why Consider It?

- Borrowers with good credit may find attractive interest rates.

- Easier approval for certain types of loans.

- Flexible terms and repayment options.

Common Uses:

- Debt consolidation

- Personal projects

- Wedding expenses

- Education costs

Advantages:

- Potential for lower interest rates, especially if you have a good credit score

- Easier access to funds without going through banks

Disadvantages:

- Interest rates may be higher for those with poor credit

- The process can be slower than traditional lending due to individual investor involvement

5. Fixed-Rate Personal Loans

What is it?

A fixed-rate personal loan is a loan where the interest rate remains constant throughout the life of the loan. This means that your monthly payments will stay the same over time, making it easier to budget.

Why Consider It?

- Predictable payments that make it easier to manage your finances.

- Ideal for those who prefer stability in their repayment plan.

Common Uses:

- Large purchases

- Debt consolidation

- Home renovations

Advantages:

- Predictable, fixed monthly payments

- Easier financial planning

- Often available for both secured and unsecured loans

Disadvantages:

- Interest rates may be higher compared to variable-rate loans (depending on your credit score)

- Limited flexibility in adjusting loan terms

6. Variable-Rate Personal Loans

What is it?

A variable-rate personal loan is a loan with an interest rate that fluctuates based on market conditions, usually tied to a benchmark like the prime rate or LIBOR (London Interbank Offered Rate). The interest rate may go up or down over time, which could change your monthly payments.

Why Consider It?

- Potential to save money if market interest rates drop.

- Lower initial rates than fixed-rate loans.

Common Uses:

- Debt consolidation

- Large purchases or expenses

- Emergency expenses

Advantages:

- Lower initial interest rates compared to fixed-rate loans

- Potential savings if interest rates decrease

Disadvantages:

- Uncertainty in monthly payments if rates rise

- Higher overall costs if interest rates increase significantly

7. Student Loan Consolidation Loans

What is it?

A student loan consolidation loan is designed to combine several student loans into one, potentially lowering the interest rate and simplifying repayment. This type of loan is typically available to those with existing federal or private student loan debt.

Why Consider It?

- Simplifies multiple student loan payments into one manageable loan.

- Could lower interest rates or extend repayment terms for easier monthly payments.

Common Uses:

- Consolidating federal and private student loans

- Refinancing student debt

Advantages:

- Simplifies student loan repayment

- Potential for lower interest rates or longer terms

- Easier to manage if you have multiple loans

Disadvantages:

- Extending repayment terms may result in paying more in interest over time

- Loss of certain benefits tied to federal loans (if consolidating federal loans into a private loan)

8. Emergency Personal Loans

What is it?

Emergency personal loans are designed for urgent financial needs, such as medical bills, unexpected repairs, or other time-sensitive expenses. These loans typically have fast approval and quick disbursement of funds.

Why Consider It?

- Provides fast access to funds in emergencies.

- Can be used for a variety of unexpected expenses, from medical bills to car repairs.

Common Uses:

- Medical emergencies

- Car repairs

- Home repairs

Advantages:

- Quick access to funds

- Flexible loan amounts

- Easy online application process

Disadvantages:

- Higher interest rates due to the quick nature of the loan

- May not be available for people with poor credit

How Do Online Personal Loans Work?

The process of obtaining an online personal loan typically follows these steps:

- Pre-Qualification: Many online lenders offer a pre-qualification process, where you can check your eligibility for a loan without affecting your credit score. During this step, lenders may ask for basic information such as your income, credit score, and the amount of money you wish to borrow.

- Application: After pre-qualification, you will need to complete a full loan application. This typically includes more detailed personal and financial information, such as proof of income, credit history, and the purpose of the loan.

- Approval: After submitting your application, the lender will review your credit report and other provided information. If you qualify, they will approve your loan. The approval process can be very fast, sometimes taking as little as a few minutes to a day.

- Loan Disbursement: Once approved, the lender will disburse the funds into your bank account. Depending on the lender, this can be done within a few hours or up to a few business days.

- Repayment: You will be required to repay the loan in fixed installments over the agreed-upon period. Payments typically occur monthly and may be set up for automatic withdrawals from your bank account.

Benefits of Online Personal Loans

- Quick and Easy Application Process: One of the key benefits of online personal loans is the streamlined application process. You can complete everything online without having to visit a physical bank branch.

- Convenience: Applying for and managing your loan can be done entirely from your computer or smartphone. This makes it incredibly convenient for borrowers who have busy schedules or live in remote areas.

- Fast Approval and Disbursement: Traditional loans can take weeks to process, but with online personal loans, approval can happen in just minutes, and funds can be disbursed within one business day.

- No Collateral Required: Many online lenders offer unsecured personal loans, meaning you don’t need to risk any assets. This is particularly attractive for borrowers who do not have valuable property to pledge.

- Competitive Rates: While unsecured loans tend to have higher interest rates, many online lenders offer competitive rates, especially for borrowers with good credit.

- Flexible Loan Amounts: Online personal loans can range from a few hundred dollars to tens of thousands, allowing you to borrow the exact amount you need for your specific financial situation.

- Transparent Terms: Reputable online lenders provide clear loan terms, including the APR, repayment period, and fees, so you can make an informed decision without any hidden surprises.

How to Apply for an Online Personal Loan

Applying for an online personal loan typically involves the following steps:

- Determine the Loan Amount: Before applying, decide how much money you need to borrow. Make sure to factor in additional costs such as fees or interest rates.

- Check Your Credit Score: Your credit score plays a significant role in determining your eligibility for a loan and the interest rate you’ll be offered. You can check your credit score for free through various online services.

- Shop Around: Take the time to compare multiple lenders to find the best rates, terms, and fees. Consider using online loan comparison tools to streamline the process.

- Gather Required Documentation: Most lenders will require documents such as proof of income, identification, and proof of address. Have these documents ready before applying.

- Submit Your Application: Fill out the application form on the lender’s website, providing the necessary details about your finances, employment, and the loan amount.

- Wait for Approval: The lender will review your application and credit history to determine if you qualify for the loan. Some lenders provide instant approval.

- Review the Loan Offer: If approved, carefully review the loan offer, including the APR, loan term, fees, and repayment schedule. If everything looks good, accept the loan offer.

- Receive Funds: Once the loan is accepted, the lender will deposit the funds into your bank account. Some lenders offer same-day or next-day funding.

- Repay the Loan: Make timely payments as per the agreed schedule. Setting up automatic payments can help you avoid missing due dates.

Factors to Consider Before Applying for an Online Personal Loan

While online personal loans offer several benefits, there are certain factors to consider before applying:

- Interest Rates: Interest rates for online personal loans can vary significantly depending on your credit score and the lender. Shop around to find the best deal.

- Loan Terms: Make sure the loan term (length of repayment) is manageable within your budget. Longer terms result in smaller monthly payments but higher total interest costs.

- Fees: Some lenders charge fees, such as origination fees, late payment fees, or prepayment penalties. Make sure to read the fine print and understand all costs involved.

- Credit Score: A higher credit score will generally get you a lower interest rate. If you have poor credit, consider seeking lenders who specialize in bad credit loans.

- Repayment Terms: Ensure that you can comfortably meet the repayment terms. Missing payments can lead to fees and negatively affect your credit score.

Also Read: Top 10 Personal Loans Online: Quick And Hassle-Free Options

Conclusion

Online personal loans are an excellent solution for anyone in need of quick, hassle-free financing. With their fast approval times, flexible loan amounts, and the convenience of managing everything online, they’re a great option for borrowers who want an easy borrowing experience. However, it’s essential to carefully evaluate lenders, understand the terms and conditions, and ensure you can comfortably repay the loan.

FAQs

1. Can I apply for an online personal loan with bad credit?

Yes, there are online lenders who specialize in loans for people with poor credit. However, expect higher interest rates and possibly lower loan amounts.

2. How quickly can I get funds from an online personal loan?

Many lenders offer same-day or next-day funding, especially if you have a verified account with them.

3. What are the eligibility requirements for an online personal loan?

Eligibility requirements vary by lender, but generally, you need to be at least 18 years old, a U.S. resident, have a steady income, and have a credit score above 600.

4. Can I use an online personal loan for any purpose?

Yes, online personal loans are typically unsecured and can be used for a variety of purposes, including debt consolidation, medical bills, home improvements, and more.

5. Are there any hidden fees associated with online personal loans?

Reputable lenders are transparent about their fees, but some may charge origination fees, late fees, or prepayment penalties. Always read the terms before accepting a loan.

6. How can I improve my chances of getting approved for an online personal loan?

To improve your chances of approval, make sure your credit score is as high as possible, provide accurate and complete information on your application, and keep your debt-to-income ratio low.

7. Is it safe to apply for an online personal loan?

Yes, it is safe as long as you apply through a reputable lender with secure, encrypted websites. Always verify the lender’s credentials before sharing personal information.