Securing a business loan is often a crucial step for entrepreneurs and business owners looking to expand, purchase equipment, or cover operating expenses. Whether you’re just starting or running an established business, obtaining financing is often necessary for growth. However, the loan application process can be complicated and competitive. This article will guide you through the essential steps to help you secure a business loan successfully. We will cover everything from preparing your business to understanding different loan types, improving your creditworthiness, and offering practical tips for a smooth loan application process.

Key Takeaways

- Prepare Thoroughly: Having your financial documents, business plan, and projections organized can make or break your loan application.

- Choose the Right Loan Type: Selecting the right loan product based on your business’s needs is crucial.

- Increase Your Creditworthiness: A higher credit score and strong cash flow will enhance your chances of securing financing.

- Understand Loan Terms: Always read the fine print and fully understand interest rates, repayment schedules, and fees before committing.

Understanding the Importance of a Business Loan

A business loan can be a game-changer for many companies. From providing the capital needed to scale operations to funding marketing campaigns, paying for inventory, or investing in new technology, a loan can serve as a financial cushion and a springboard for growth. However, understanding the process and approaching it strategically is essential to increase your chances of getting approved.

Business loans come in many forms, with varying terms, interest rates, and repayment schedules. Whether you choose a traditional loan from a bank, an SBA (Small Business Administration) loan, or an alternative financing option, securing funding can help stabilize your business in the short term and fuel its long-term success.

Types of Business Loans

Before diving into the process of securing a loan, it’s important to understand the different types of loans available. Each loan type has unique characteristics, and you’ll need to select the one that best fits your business needs. Some of the most common types of business loans include:

1. Term Loans

A term loan is one of the most straightforward and traditional types of business loans. It provides a lump sum of capital, which you must repay over a fixed term with interest. This type of loan is typically used for long-term investments or major business expenses such as purchasing equipment, real estate, or expanding operations.

- Loan Amount: Fixed amount of money.

- Repayment Period: Typically ranges from one to ten years.

- Interest Rate: Can be fixed or variable.

- Use Case: Expanding business operations, purchasing assets, or funding large projects.

2. SBA Loans

SBA loans are small business loans that are partially guaranteed by the U.S. Small Business Administration. They are designed to help small businesses that might not qualify for traditional loans. SBA loans often come with lower interest rates and longer repayment terms, making them an attractive option for businesses seeking affordable financing.

- Loan Amount: Can range from a few thousand to several million dollars, depending on the program.

- Repayment Period: Can be up to 25 years for real estate or 10 years for equipment.

- Interest Rate: Generally lower than conventional loans.

- Use Case: Working capital, real estate purchases, equipment acquisition, or business expansion.

3. Business Line of Credit

A business line of credit functions like a credit card for businesses. It provides access to a specific amount of funds, which can be drawn upon as needed. You only pay interest on the amount you borrow, making it an excellent option for businesses that require flexibility to cover ongoing operating expenses or short-term cash flow needs.

- Loan Amount: Pre-approved credit limit, often ranging from $10,000 to $500,000.

- Repayment Period: Revolving (you can borrow and repay as needed).

- Interest Rate: Generally variable.

- Use Case: Managing cash flow, covering operating expenses, or funding unexpected costs.

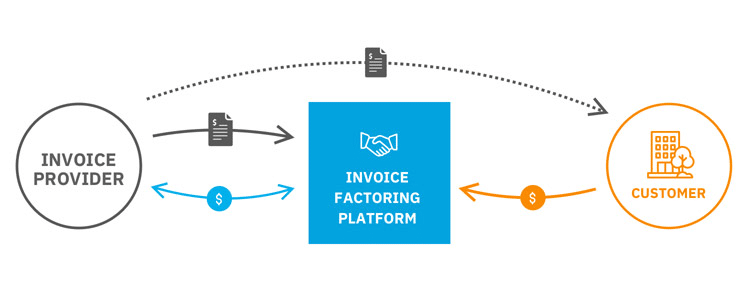

4. Invoice Financing (Factoring)

Invoice financing allows businesses to borrow money against the value of their unpaid invoices. This type of loan is beneficial for businesses that provide goods or services on credit and need quick access to cash while waiting for customers to pay their invoices.

- Loan Amount: Typically up to 85-90% of the value of the unpaid invoices.

- Repayment Period: Based on the invoice due date.

- Interest Rate: Generally higher than traditional loans, with additional fees.

- Use Case: Improving cash flow while awaiting customer payments.

5. Merchant Cash Advance (MCA)

A merchant cash advance is a short-term loan option where businesses receive a lump sum of capital in exchange for a percentage of their future sales or credit card transactions. This type of loan is easier to obtain but can come with high-interest rates and short repayment periods, making it best suited for businesses with steady daily sales.

- Loan Amount: Can vary, typically up to $250,000 or more.

- Repayment Period: Typically short-term, ranging from a few months to a year.

- Interest Rate: Generally high due to the risk.

- Use Case: Covering urgent business expenses, particularly for businesses with steady daily credit card sales.

6. Equipment Financing

Equipment financing is a loan specifically designed to help businesses purchase new or used equipment. The equipment itself often serves as collateral for the loan, making it easier to secure. This type of loan is ideal for businesses that rely on specialized machinery or tools for their operations.

- Loan Amount: Typically covers up to 100% of the cost of the equipment.

- Repayment Period: Varies, often between 1 to 5 years.

- Interest Rate: Can be fixed or variable.

- Use Case: Purchasing machinery, technology, or other business equipment.

7. Commercial Real Estate Loans

Commercial real estate loans are used to purchase, refinance, or renovate business properties. These loans can be used for buying office space, retail stores, warehouses, or industrial properties. They typically require a down payment and offer long repayment terms.

- Loan Amount: Can be substantial, depending on the value of the property.

- Repayment Period: Typically 10-25 years.

- Interest Rate: Can vary but is usually lower for well-established businesses with strong credit.

- Use Case: Purchasing or refinancing commercial property, office space, or industrial real estate.

8. Short-Term Business Loans

Short-term business loans provide quick access to capital for businesses that need funds in the short term. These loans are typically paid back within a year and are ideal for businesses that require fast funding for immediate needs.

- Loan Amount: Often up to $500,000.

- Repayment Period: Short, usually 3-18 months.

- Interest Rate: Higher than long-term loans due to the shorter repayment period.

- Use Case: Covering temporary cash flow gaps, seasonal expenses, or unexpected costs.

9. Business Credit Cards

While not traditionally viewed as a loan, business credit cards are a form of revolving credit that can be used for everyday expenses. They are convenient and flexible, allowing business owners to pay for supplies, marketing, or other operational costs while managing cash flow.

- Loan Amount: Based on credit limit, which can range from $1,000 to $100,000 or more.

- Repayment Period: Revolving, with a minimum monthly payment.

- Interest Rate: Typically higher than traditional loans.

- Use Case: Day-to-day business expenses, emergency funding, or short-term purchases.

10. Peer-to-Peer (P2P) Loans

Peer-to-peer lending platforms connect businesses directly with individual investors who are willing to lend money. This option provides more flexibility than traditional banks and can be an appealing choice for small businesses that may struggle to obtain financing through conventional routes.

- Loan Amount: Varies based on the platform and the borrower’s creditworthiness.

- Repayment Period: Varies, typically 1 to 5 years.

- Interest Rate: Can be competitive, depending on the business’s credit profile.

- Use Case: Business expansion, covering operating costs, or consolidating debt.

Preparing for the Loan Application

1. Evaluate Your Financial Needs

Before applying for a loan, it’s crucial to evaluate why you need the loan and determine the exact amount of capital required. Lenders are more likely to approve your loan if they understand exactly how you plan to use the funds and how it will benefit your business.

- Assess Your Requirements: Start by understanding your financial needs. Do you need funds to cover operational costs, expand your business, or purchase equipment? Be specific about the amount required for each purpose.

- Calculate Loan Amount: Once you have identified your financial needs, calculate the precise loan amount you need. Avoid borrowing more than you need, as lenders may be more hesitant to approve larger loan amounts.

- Plan for Repayment: Understand how you will repay the loan. Create a plan for how the loan will help your business generate enough revenue to make timely repayments. Being prepared to explain this to the lender will improve your credibility.

2. Organize Your Financial Documents

One of the most important parts of the loan application process is presenting your financial information in an organized manner. Lenders will use your financial documents to evaluate your business’s profitability, liquidity, and overall health. To ensure your loan application stands out, gather and organize the following documents:

- Business Tax Returns: Provide the last 2-3 years of business tax returns. This helps lenders assess your business’s profitability and overall financial health.

- Profit and Loss (P&L) Statement: This statement summarizes your business’s revenues, costs, and expenses over a specified period, typically one year. Lenders use this document to assess whether your business is profitable and capable of repaying the loan.

- Balance Sheet: A balance sheet provides an overview of your company’s assets, liabilities, and equity at a specific point in time. It helps lenders understand the financial stability and solvency of your business.

- Cash Flow Statement: Lenders are particularly interested in your cash flow, as it shows your ability to generate enough revenue to meet day-to-day expenses and make loan repayments. Be prepared to provide monthly or quarterly cash flow statements.

- Bank Statements: Provide your most recent business bank statements to show lenders your current cash position and how you manage your finances on a day-to-day basis.

- Personal Financial Statements: In some cases, particularly for small businesses or startups, lenders may require the personal financial statements of business owners or guarantors. This helps assess your financial stability and personal creditworthiness.

3. Check Your Credit Score

Lenders will review both your personal and business credit scores to determine your ability to repay the loan. A high credit score signals financial responsibility, while a low score may raise concerns about your ability to manage debt.

- Personal Credit Score: Lenders may check the credit score of the business owner, especially if the business is a sole proprietorship or if the loan is unsecured. Aim for a personal credit score of at least 650, although some lenders may accept lower scores for certain types of loans.

- Business Credit Score: If your business is established, your business credit score will be an essential factor in the loan approval process. A higher score improves your chances of approval and may lead to better loan terms.

- Check Your Scores: Before applying for a loan, check both your personal and business credit scores. If your scores are lower than desired, take steps to improve them before submitting your application. Pay off any outstanding debts, correct errors on your credit report, and reduce your credit utilization ratio.

4. Strengthen Your Business Plan

A strong business plan is an essential part of your loan application. It demonstrates to lenders that you have a clear vision for your business, a strategy for growth, and a plan for managing the loan effectively.

- Executive Summary: Begin with a brief overview of your business, including its mission, vision, products or services, and key differentiators in the marketplace.

- Market Research and Analysis: Provide data on your target market, industry trends, competition, and potential for growth. A well-researched market analysis shows lenders that you have a good understanding of your business environment and market dynamics.

- Financial Projections: Include 3-5 years of financial projections that outline expected revenue, expenses, and profits. This helps lenders assess your business’s growth potential and ability to repay the loan.

- Repayment Strategy: Detail how you plan to repay the loan. Lenders want to know that you have a strategy for utilizing the funds and generating sufficient revenue to meet repayment obligations.

5. Determine the Type of Loan You Need

Understanding which type of loan best suits your business needs is crucial to the application process. Different loan types have different requirements, interest rates, and repayment schedules. Before applying, determine the loan type that will best address your business goals.

- Short-Term vs. Long-Term Loan: If you need funding for an urgent project or short-term cash flow gap, a short-term loan or line of credit may be the best option. For larger investments or expansion projects, a long-term loan may be a better fit.

- Secured vs. Unsecured Loan: Decide whether you’re willing to offer collateral for a secured loan. If not, an unsecured loan might be a better option, but it may come with higher interest rates and stricter credit requirements.

- Loan Amount: Be clear about how much funding you need, keeping in mind that applying for more than you need could lower your chances of approval.

6. Choose the Right Lender

Once you’ve prepared your financial documents and business plan, it’s time to choose the right lender for your needs. Different lenders have different approval processes, interest rates, and loan terms. Some lenders cater to startups or small businesses, while others work exclusively with large corporations.

- Traditional Banks: Banks are the most common option for business loans, but they typically have stringent requirements and may take longer to process applications.

- Credit Unions: Credit unions can offer lower interest rates and more flexible terms compared to traditional banks. They may be a good option if you have an established relationship with one.

- Online Lenders: Online lenders offer faster approval and disbursement times but may have higher interest rates than banks. They can be a good choice for businesses that need quick access to capital.

- Alternative Lenders: Peer-to-peer lenders, angel investors, and venture capitalists are alternative sources of funding, especially for businesses with high growth potential but limited credit history.

7. Prepare for the Interview

Many lenders require a face-to-face meeting or interview to assess your business’s suitability for a loan. Be ready to answer questions about your business, its financial history, and your plans for the future.

- Be Transparent: Lenders will appreciate honesty about your business’s financial position, especially if you’re facing challenges. Providing a clear plan for overcoming any obstacles will show lenders that you are proactive and capable of managing your business responsibly.

- Demonstrate Your Expertise: Highlight your experience, industry knowledge, and your ability to lead the business. Lenders want to know that they are lending money to a knowledgeable and competent business owner.

- Know Your Numbers: Be prepared to discuss your financial statements, projections, and cash flow in detail. You should be able to confidently explain how the loan will be used and how it will benefit your business.

How to Improve Your Chances of Approval

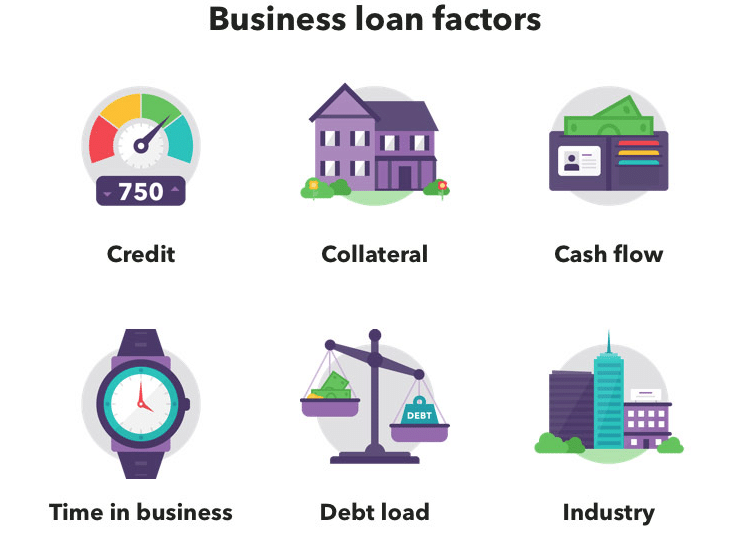

Securing a business loan is not always a straightforward process, and lenders often evaluate various factors before approving your application. To increase your chances of success, consider the following tips:

Improve Your Business Credit Score

Just like your personal credit score, your business credit score plays a significant role in whether a lender will approve your loan. A higher credit score signals financial responsibility and reduces the risk for lenders. Here are some tips to improve your business credit score:

- Pay all bills and loans on time

- Reduce your debt levels

- Maintain a low credit utilization ratio

Strengthen Your Business Plan

A solid business plan is critical for securing financing. It helps demonstrate that you have a clear roadmap for your business and an effective strategy to repay the loan. A strong business plan should include:

- An executive summary outlining your business’s mission and objectives

- A description of your products or services

- A market analysis that highlights industry trends and competitors

- Financial projections for the next 3-5 years

Demonstrate a Steady Cash Flow

Lenders want to ensure that your business has the capacity to repay the loan. A proven track record of stable cash flow increases the likelihood of approval. You can demonstrate steady cash flow by providing:

- Historical revenue and profit data

- Projected income statements for the next 12 months

- Bank statements

Offer Collateral

Collateral is a form of security for the lender, and it can be required for certain types of loans. Offering collateral reduces the risk for the lender and can sometimes increase the chances of approval. Collateral can include real estate, equipment, inventory, or other business assets.

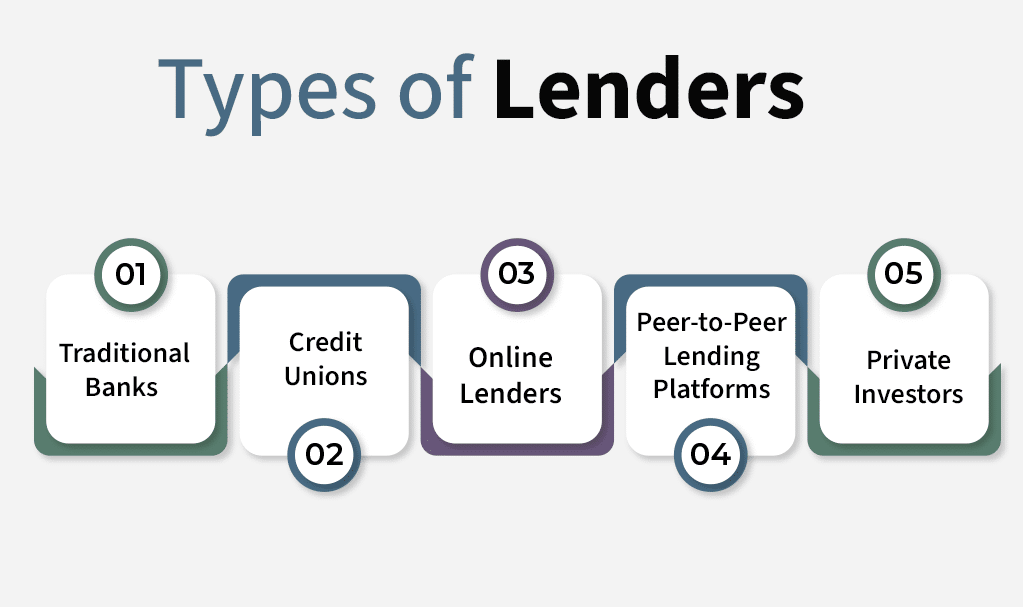

Types of Lenders You Can Approach

Once you’re prepared, the next step is to find the right lender for your business loan. Different lenders have different requirements, interest rates, and approval processes. Here are the most common types of lenders:

- Traditional Banks: Banks are the most well-known lenders, offering competitive interest rates and long-term loan options. However, they typically have stringent approval criteria and long application processes.

- Credit Unions: Similar to banks, credit unions often provide small business loans, but they may have more flexible lending requirements.

- Online Lenders: Online lending platforms have grown in popularity in recent years due to their speed and convenience. They offer shorter application processes, but interest rates may be higher than traditional banks.

- Alternative Lenders: Peer-to-peer lending platforms, crowdfunding, and other non-bank lending options are available for businesses looking for alternative funding sources.

How to Apply for a Business Loan

Once you’ve selected the type of loan and lender that fits your business needs, the next step is to complete the application. Each lender will have their own specific process, but here’s a general guide to what you can expect:

- Complete the Application: Fill out the loan application form, providing the necessary information about your business and financial situation.

- Submit Supporting Documents: Attach the financial documents, business plan, and any other required paperwork.

- Wait for Approval: Lenders will review your application and may request additional information. If you are approved, the lender will provide you with loan terms.

- Review Loan Terms: Carefully review the loan terms, including the interest rate, repayment schedule, and any fees.

- Sign the Agreement: If you agree to the terms, sign the loan agreement, and the funds will be disbursed to your account.

Common Pitfalls to Avoid

- Over-borrowing: Be realistic about how much money you actually need. Borrowing too much can lead to difficulties in repayment.

- Skipping the Research: Always compare loan options and lenders. Choose the one that offers the best terms for your business.

- Not Understanding Fees: Ensure you fully understand any additional fees or hidden costs associated with the loan.

- Neglecting Cash Flow: Lenders often scrutinize cash flow, so neglecting to plan your finances carefully can hurt your chances of approval.

Also Read : How Can Your Business Loan Refinancing Improve Your Financial Strategy?

Conclusion

Securing a business loan can be a daunting process, but with the right preparation and strategy, it’s entirely possible to secure the financing you need to grow your business. By understanding the types of loans available, improving your credit score, presenting a solid business plan, and selecting the right lender, you’ll increase your chances of success.

Remember to carefully assess your financial needs, research your loan options, and avoid common mistakes to ensure a smooth borrowing experience.

Frequently Asked Questions (FAQs)

How do I know how much loan I need?

Evaluate your current business expenses, projected growth, and investment needs to determine the precise amount.

How long does it take to get approved for a business loan?

Traditional loans may take several weeks, while online lenders can approve loans in as little as a few days.

Can I get a loan with bad credit?

While it’s more challenging, there are options for businesses with bad credit, such as SBA loans or alternative lenders.

What collateral do I need to secure a loan?

Collateral can include assets such as real estate, equipment, or inventory, depending on the type of loan.

What happens if I can’t repay the loan?

If you’re unable to repay the loan, your lender may seize the collateral, and it could damage your business’s credit score.

Do I need a business plan to apply for a loan?

A business plan isn’t always required, but having one greatly improves your chances of approval, especially for larger loans.

Can I apply for multiple loans at once?

While you can apply for multiple loans, it’s important to be strategic and avoid overextending your business financially.