Starting and running a business loan for small business is a rewarding yet challenging endeavor. Whether you’re looking to expand your operations, purchase new equipment, hire more staff, or cover other business expenses, securing funding is often necessary to fuel growth. A business loan can be an invaluable tool in providing the financial backing you need to succeed. However, the process of securing a business loan for a small business can be complex, and many entrepreneurs struggle to navigate the various options and requirements.

This article will provide a comprehensive guide on how to secure a business loan for a small business, offering essential tips and strategies to help you through the process. We’ll cover everything from understanding your financing options and improving your creditworthiness to preparing your application and choosing the right lender for your business needs.

Key Takeaways:

- Understand your loan options (term loans, SBA loans, lines of credit, etc.) to find the right fit for your business needs.

- Improve your creditworthiness by reviewing your credit score, reducing debt, and building a strong business credit history.

- Prepare a detailed business plan, organize financial documents, and provide collateral if necessary to strengthen your loan application.

- Choose the right lender by comparing terms, evaluating customer service, and considering both traditional banks and alternative lenders.

Understanding Business Loan for Small Business

Before you begin the application process, it’s essential to understand the different types of business loans available to small businesses. Depending on your needs, some loan options may be more suitable than others. Here are the most common types of business loans:

Term Loans

A term loan is one of the most traditional types of business loans. It typically involves borrowing a lump sum of money from a bank or financial institution and repaying it in regular installments over a set period, often with fixed or variable interest rates. Term loans can be short-term (less than a year) or long-term (several years).

Best For: Small businesses looking to make a large investment in equipment, expansion, or other long-term growth strategies.

SBA Loans

The U.S. Small Business Administration (SBA) offers loans that are partially guaranteed by the government. These loans come with favorable terms, such as lower interest rates and longer repayment periods, making them an attractive option for small businesses. SBA loans can be used for various purposes, including working capital, equipment, and real estate.

Best For: Small businesses with solid credit history and the ability to demonstrate a clear repayment plan.

Lines of Credit

A business line of credit is a flexible financing option that allows you to borrow up to a pre-approved limit whenever needed. Unlike term loans, which provide a lump sum of money, a line of credit allows you to withdraw funds as necessary and only pay interest on the amount you borrow.

Best For: Small businesses that need access to working capital for ongoing expenses or fluctuating cash flow.

Business Credit Cards

Business credit cards offer another flexible financing option for small businesses. They allow you to borrow up to a certain limit and pay interest on the balance if not paid off in full each month. Business credit cards can be used for everyday expenses and come with rewards or cashback programs.

Best For: Small businesses with manageable expenses that want to build credit and earn rewards on purchases.

Equipment Financing

Equipment financing is specifically designed for businesses that need to purchase new equipment. With this type of loan, the equipment itself serves as collateral, which reduces the lender’s risk. These loans typically have lower interest rates and longer repayment periods compared to traditional term loans.

Best For: Businesses that need to purchase expensive equipment for operations but don’t have the upfront cash.

Invoice Financing

Invoice financing is a type of loan where businesses can borrow against their outstanding invoices. Lenders provide a cash advance based on the value of unpaid invoices, and businesses repay the loan when the customer pays the invoice. This is a great option for businesses with slow-paying clients.

Best For: Businesses that need to bridge cash flow gaps while waiting for customer payments.

Merchant Cash Advances

A merchant cash advance (MCA) is a short-term loan option where the lender provides a lump sum of money in exchange for a percentage of your future sales. This loan is repaid daily or weekly through a portion of your business’s credit card sales.

Best For: Businesses with high credit card sales that need quick access to capital but may have poor credit or cash flow problems.

How to Improve Your Creditworthiness Before Applying

Your creditworthiness plays a significant role in the likelihood of securing a business loan. Lenders assess your credit score and financial history to determine how risky it is to lend to your business. Here are some essential strategies to improve your creditworthiness before applying for a business loan:

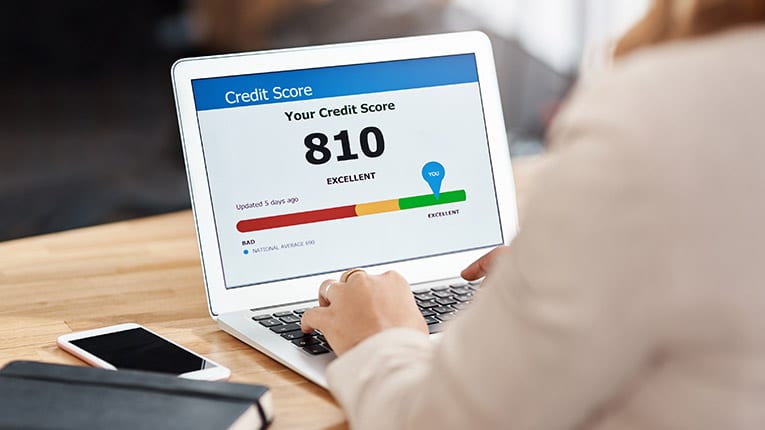

Check Your Personal and Business Credit Scores

Most small business lenders will look at both your personal and business credit scores. Personal credit scores are typically evaluated for smaller loans, while business credit scores are more important for larger loans. You can obtain both scores from major credit bureaus like Experian, Equifax, and TransUnion.

Tip: If your credit score is lower than you’d like, take time to improve it by paying down existing debt and avoiding late payments.

Pay Off Outstanding Debts

Paying off existing debts, including credit cards, loans, and lines of credit, can improve your creditworthiness. Reducing your debt-to-income ratio shows lenders that you can manage your financial obligations responsibly.

Build a Strong Business Credit History

If your business doesn’t have a credit history yet, it’s essential to start building one. You can do this by opening a business credit card, paying bills on time, and establishing credit accounts with vendors that report to business credit bureaus.

Ensure Your Financials Are in Order

Lenders will require financial statements, including balance sheets, income statements, and cash flow statements, to assess the health of your business. Keeping your finances organized and accurate is crucial when applying for a business loan.

Reduce Your Business’s Debt Load

If your business is carrying a significant amount of debt, it could be a red flag for lenders. Reducing the debt load by paying off outstanding loans or restructuring your obligations can make you a more attractive candidate for a loan.

How to Prepare a Strong Business Loan Application

Once you’ve determined the type of loan that best suits your business needs and improved your creditworthiness, it’s time to start preparing your loan application. A well-prepared loan application increases your chances of approval and helps lenders assess your business’s potential for success.

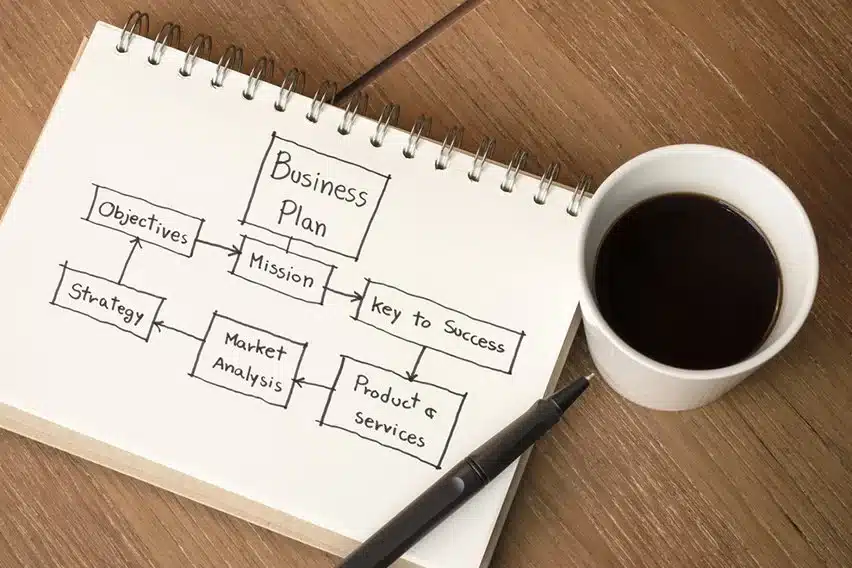

Create a Detailed Business Plan

A solid business plan is one of the most important components of your loan application. It should include a detailed overview of your business, including its mission, goals, target market, competitive landscape, and financial projections. A clear and well-organized business plan demonstrates to lenders that you have a strategy for growth and repayment.

Gather Financial Documents

Lenders will require various financial documents to assess your business’s financial health. These may include:

- Income statement (profit and loss statement)

- Balance sheet

- Cash flow statement

- Tax returns (typically the last two years)

- Bank statements

- Loan history

Make sure these documents are up-to-date and well-organized before submitting your application.

Provide Collateral

Some business loans may require collateral to secure the loan. Collateral is an asset (like property or equipment) that the lender can seize if the loan is not repaid. Offering collateral can increase your chances of loan approval, especially if your business has limited credit history or a lower credit score.

Show Proof of Business Revenue

Lenders want to see that your business is generating consistent revenue. Provide financial records that demonstrate your sales, including sales reports, contracts, and invoices. The more evidence you can provide of your revenue and profitability, the better your chances of securing a loan.

Prepare for Lender Questions

Lenders will likely ask you questions regarding your business’s operations, plans for growth, and ability to repay the loan. Be prepared to answer questions about your cash flow, how you plan to use the loan funds, and your repayment strategy. Being well-prepared will instill confidence in the lender and increase the likelihood of approval.

Choosing the Right Lender

The lender you choose will play a significant role in the terms of your loan, including the interest rate, repayment period, and fees. Here are a few things to consider when selecting a lender:

Traditional Banks vs. Alternative Lenders

Traditional banks typically offer competitive interest rates and favorable terms but may have stringent requirements for approval. If your business has a strong credit history and established revenue, a bank loan may be a good option. However, alternative lenders, such as online lenders or peer-to-peer lending platforms, may be more lenient with their requirements and offer faster access to funds.

Compare Loan Terms

Different lenders offer varying loan terms, so it’s essential to compare offers before making a decision. Pay attention to interest rates, repayment periods, fees, and any prepayment penalties. Choose a lender whose terms align with your business’s financial capacity.

Evaluate Customer Service

The customer service and support provided by the lender is also important. You want a lender that is responsive to your needs and willing to guide you through the loan process. Read reviews and ask for recommendations from other business owners to ensure you choose a lender that offers great customer service.

Types of Business Loans for Small Businesses

Understanding the different types of business loans available is crucial to choosing the best option for your specific needs. Here are some of the most common types of business loans:

Term Loans

A term loan is a lump sum of money that you borrow from a bank or lender, which you repay in fixed installments over a set period (ranging from one year to several years). This type of loan typically comes with fixed or variable interest rates.

- Best For: Small businesses that need a lump sum of money for a specific purpose, such as buying equipment, purchasing real estate, or expanding operations.

- Pros: Predictable payments and longer repayment periods.

- Cons: Interest rates can be higher for businesses with poor credit, and the application process can be lengthy.

SBA Loans

The U.S. Small Business Administration (SBA) offers loan programs that are partially guaranteed by the federal government. SBA loans come with favorable terms, such as lower interest rates, longer repayment periods, and more lenient qualifications.

- Best For: Small businesses that may not qualify for traditional loans or need more affordable financing options.

- Pros: Lower interest rates, longer repayment terms, and flexible qualifications.

- Cons: The application process can be lengthy, and there are strict eligibility requirements.

Business Line of Credit

A business line of credit is a revolving credit line that allows you to borrow money as needed up to a predetermined limit. You only pay interest on the amount you borrow, and you can borrow and repay repeatedly, making this a flexible option for managing cash flow.

- Best For: Small businesses that need flexible access to funds for day-to-day expenses or working capital.

- Pros: Flexibility to borrow only when needed, and you only pay interest on the amount you use.

- Cons: Interest rates can be higher than traditional loans, and the credit limit may be lower for businesses with poor credit.

Business Credit Cards

Business credit cards are a convenient way for small businesses to access credit for everyday expenses. They offer revolving credit lines, which means you can use the card up to your credit limit and repay it over time.

- Best For: Small businesses with manageable expenses that want to build or improve business credit while earning rewards.

- Pros: Quick access to funds, rewards programs, and a simple application process.

- Cons: High-interest rates if the balance is not paid off quickly, and credit limits may be lower for smaller businesses.

Equipment Financing

Equipment financing is a loan specifically designed to help businesses purchase equipment, whether it’s for construction, manufacturing, or other operational needs. The equipment itself serves as collateral, which reduces the lender’s risk and often results in more favorable loan terms.

- Best For: Businesses that need expensive equipment to operate but don’t have the upfront capital.

- Pros: The equipment acts as collateral, and the loan typically comes with lower interest rates.

- Cons: You need to have a clear plan for how the equipment will generate revenue, and the loan is specifically for equipment purchases.

Invoice Financing

Invoice financing allows businesses to borrow money against outstanding invoices. This is particularly useful for businesses with slow-paying clients or those facing cash flow gaps due to unpaid invoices.

- Best For: Businesses that offer credit to clients and have significant outstanding invoices.

- Pros: Quick access to funds without needing to wait for client payments, and the loan is secured by the value of the invoices.

- Cons: Fees and interest rates can be high, and the loan amount is limited to the value of the invoices.

Merchant Cash Advances

A merchant cash advance (MCA) provides businesses with a lump sum of capital in exchange for a percentage of future sales. The lender collects daily or weekly repayments based on the business’s daily credit card sales.

- Best For: Businesses with high credit card sales and those needing quick access to funds.

- Pros: Fast approval and funding, and flexible repayment tied to sales.

- Cons: High fees and interest rates, and repayment can be challenging during slow sales periods.

How to Qualify for a Business Loan

Lenders typically assess a range of factors before approving a loan application. Here are some of the key criteria that lenders look for when evaluating small business loan applications:

Credit Score

Your personal credit score is one of the first things lenders will review. A higher credit score indicates that you are responsible with credit and have a history of paying debts on time. For businesses with an established credit history, business credit scores are also considered.

- Tip: A credit score of 680 or higher is typically considered good for business loans. If your score is lower, consider improving it before applying.

Time in Business

Lenders want to see that your business has been operating for a reasonable amount of time. While start-ups may qualify for some loans, many traditional lenders prefer businesses that have been in operation for at least two years.

- Tip: If you’re a new business, consider seeking out alternative lenders or government-backed loans that are more lenient with time in business requirements.

Annual Revenue

Lenders want to know that your business is generating enough revenue to repay the loan. Many lenders set minimum revenue thresholds that your business must meet to qualify for a loan.

- Tip: Review your business’s financial statements and make sure you can demonstrate consistent revenue growth.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a critical factor in assessing your ability to manage additional debt. Lenders typically prefer a DTI ratio under 40%, though this can vary.

- Tip: Lower your existing debt or restructure your obligations to improve your DTI ratio before applying for a new loan.

Collateral

Some loans, particularly larger ones, may require collateral to secure the loan. This could include assets like property, equipment, or inventory that the lender can seize if the loan is not repaid.

- Tip: Offering collateral can increase your chances of securing a loan, especially if your credit is not stellar.

Business Plan

A solid business plan is essential when applying for a business loan. Your business plan should clearly outline your business model, target market, revenue projections, and how you plan to use the loan funds. A well-prepared business plan demonstrates to lenders that you have a clear strategy for growth and financial management.

- Tip: Take time to develop a comprehensive business plan, and be ready to explain how the loan will benefit your business.

How to Apply for a Business Loan

The process of applying for a business loan can vary depending on the lender. However, there are some basic steps involved in most loan applications:

Choose the Right Loan Type

Start by selecting the loan type that best fits your business needs. Consider factors such as how much money you need, your ability to repay, and the purpose of the loan.

Gather Required Documentation

Lenders will require certain documents to process your loan application. This typically includes financial statements, tax returns, business plans, and possibly collateral documentation. Make sure your documents are organized and up-to-date.

Submit Your Application

Complete the loan application provided by the lender, and submit all required documents. Be prepared to answer any additional questions or provide further clarification if requested.

Wait for Approval

Once you submit your application, the lender will review your financial history, business plan, and other criteria before making a decision. This process can take anywhere from a few days to several weeks, depending on the lender.

Review the Loan Offer

If approved, the lender will present you with a loan offer outlining the terms and conditions. Review the offer carefully, paying attention to the interest rate, repayment schedule, fees, and any other terms.

Accept the Loan and Receive Funds

Once you accept the loan offer, the lender will disburse the funds to your business. The funds will be available for you to use as outlined in the loan agreement.

Also Read: How To Secure A Business Loan: Tips For Success

Conclusion

Securing a business loan for a small business is an important step in fueling growth, improving operations, or managing cash flow. While the process can seem overwhelming, understanding your loan options, improving your creditworthiness, and preparing a thorough application can significantly improve your chances of success. By taking the time to choose the right lender and carefully considering the terms of the loan, you can secure the funding needed to help your small business thrive.

FAQs

What is the best type of loan for a small business?

The best loan for a small business depends on the purpose of the loan. Term loans are ideal for large investments, SBA loans are great for businesses looking for low rates and longer terms, while lines of credit are perfect for working capital.

How can I improve my chances of getting a business loan?

Improve your chances by maintaining a good credit score, preparing a detailed business plan, organizing your financial records, and ensuring your business has steady revenue.

How long does it take to get a business loan?

The time it takes to get a business loan depends on the lender and the type of loan. Bank loans may take weeks, while alternative lenders can approve loans within a few days.

Do I need collateral to secure a business loan?

Not all loans require collateral, but offering collateral can increase your chances of approval, particularly for larger loans or if your business has limited credit history.

What is the minimum credit score required for a business loan?

Credit score requirements vary by lender and loan type. Typically, a score of 680 or higher is considered good, but alternative lenders may accept lower scores.

Can I apply for a business loan with bad credit?

Yes, but it may be more difficult. Alternative lenders may offer options for businesses with lower credit scores, but you may face higher interest rates and less favorable terms.

Are there any fees associated with business loans?

Yes, business loans often come with fees such as origination fees, application fees, and prepayment penalties. Be sure to understand all associated costs before applying.