Starting or expanding a small business often requires quick access to capital. Traditional bank loans are not always an option, particularly for newer businesses without a long credit history or substantial collateral. This is where unsecured loans come into play. Unsecured loans provide a fast, flexible, and accessible financing solution for small business owners who need funding but do not want to risk their personal assets or business collateral. In this article, we will explore the benefits, types, and considerations of unsecured loans for small businesses, providing you with a comprehensive understanding of how they can be a valuable tool for your entrepreneurial needs.

Key Takeaway

Unsecured loans offer small businesses the opportunity to access funding quickly and without the need for collateral. They are an excellent option for new businesses, startups, and those needing flexible financing for various purposes. While interest rates may be higher, the ability to obtain funds without risking valuable assets makes unsecured loans a powerful tool for business growth and stability.

What Are Unsecured Loans for Small Business?

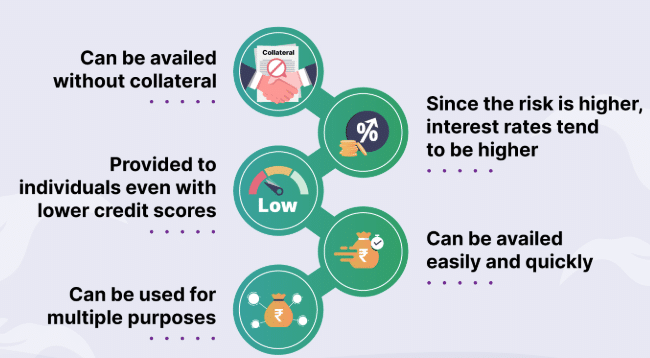

Unsecured loans for small businesses are loans that do not require the borrower to provide any collateral, such as personal property or business assets, as security for the loan. Instead of relying on collateral, lenders assess the borrower’s creditworthiness, financial health, and the potential of the business to repay the loan. These loans are typically granted based on the borrower’s credit score, business financials, and cash flow.

Since unsecured loans do not have collateral backing them, they are considered riskier for lenders. As a result, they often come with higher interest rates compared to secured loans. However, they offer the advantage of not putting your personal or business assets at risk in the event that you are unable to repay the loan.

Unsecured loans for small businesses can be used for various purposes, including working capital, purchasing equipment, expanding operations, or covering unexpected expenses. They offer flexibility, faster approval processes, and are particularly useful for businesses that may not have enough assets to offer as collateral.

Here are the key characteristics of unsecured loans for small businesses:

1. No Collateral Required

Unlike secured loans that require collateral, unsecured loans do not require the borrower to pledge assets such as real estate, equipment, or inventory.

2. Higher Interest Rates

Since unsecured loans are riskier for lenders, they often come with higher interest rates. Lenders compensate for the higher risk by charging more for borrowing.

3. Faster Approval Process

Since there is no collateral to evaluate, unsecured loans often have a quicker application and approval process. This makes them a convenient option for business owners who need immediate access to funds.

4. Flexible Use of Funds

Unsecured loans can be used for a wide range of business purposes, from day-to-day expenses to expansion efforts, giving the borrower greater flexibility in how the funds are utilized.

5. Eligibility Based on Creditworthiness

Lenders base their approval on the borrower’s credit score, revenue, cash flow, and overall financial health. A strong credit history and a solid business plan can improve the chances of approval.

6. Shorter Loan Terms

Unsecured loans often come with shorter repayment terms compared to secured loans. While the exact term varies, it is generally between one and five years.

7. No Risk to Business Assets

Since there is no collateral involved, businesses do not risk losing their assets, such as equipment or property, if they are unable to repay the loan.

Unsecured loans for small businesses can be an excellent solution for business owners who need quick access to capital but do not have valuable assets to secure a loan. However, the higher interest rates and stringent qualification requirements mean that businesses must carefully assess whether an unsecured loan is the right financing option for their needs.

Why Choose Unsecured Loans for Small Businesses?

\

Unsecured loans offer a range of benefits for small businesses, making them an attractive financing option for entrepreneurs who may not have sufficient collateral to secure traditional loans. These loans can be a powerful tool for business growth, providing access to the capital needed to invest in expansion, improve cash flow, or cover emergency expenses. Here are several key reasons why small business owners might choose unsecured loans:

1. No Collateral Required

One of the primary advantages of unsecured loans is that they do not require the borrower to provide collateral, such as property, inventory, or other business assets. This makes them an ideal solution for small business owners who do not have valuable assets to pledge or are unwilling to risk their assets in the event of financial hardship. It also eliminates the need to tie up personal or business property, allowing the owner to retain full control over their assets.

2. Quick and Easy Access to Funds

Since unsecured loans do not require the evaluation of collateral, the approval and disbursement process is often faster than secured loans. In many cases, business owners can receive the funds they need in a matter of days or even hours, depending on the lender. This speed can be critical when a business needs quick access to cash, whether to cover payroll, purchase inventory, or seize a time-sensitive opportunity.

3. Flexible Use of Funds

Unsecured loans provide flexibility in how the funds can be used, which is essential for small business owners who may need money for various reasons. Whether it’s working capital to cover operational costs, funding to expand the business, or money to invest in marketing and advertising, an unsecured loan offers the freedom to use the capital as needed. This flexibility is a major benefit over some forms of secured lending, where the use of funds may be restricted.

4. Maintain Ownership of the Business

Since unsecured loans do not involve offering collateral, small business owners can maintain full ownership and control over their businesses. Unlike equity financing, where a business may need to give up a portion of ownership to investors, unsecured loans allow owners to keep their stake in the company. This is particularly important for entrepreneurs who want to retain decision-making authority and avoid diluting their ownership.

5. Faster Application Process

The application process for unsecured loans is typically quicker and more straightforward compared to secured loans. Lenders focus on assessing the financial health of the business, the owner’s creditworthiness, and the overall ability to repay the loan. As a result, businesses do not need to submit detailed collateral documentation, which can be time-consuming and cumbersome. This faster process is a significant advantage for small businesses that need funds quickly to address immediate financial challenges.

6. Lower Risk to Personal Assets

For business owners who do not want to put their personal assets at risk, unsecured loans are an attractive option. In secured loans, personal or business assets may be seized if the loan is not repaid. With unsecured loans, however, there is no collateral involved, and although the lender may take legal action in the case of non-repayment, personal assets are typically protected (depending on the loan agreement and local laws).

7. No Impact on Business Assets

Since unsecured loans do not require collateral, small businesses can obtain financing without jeopardizing their physical assets, such as equipment, real estate, or inventory. This means that the business can continue to use its assets for daily operations without the risk of having them liquidated to repay the loan.

8. Access to Larger Loan Amounts

While unsecured loans generally have higher interest rates compared to secured loans, many lenders are still willing to offer substantial loan amounts based on the business’s financial health and creditworthiness. Depending on the lender and the business’s performance, small businesses can secure significant funding that can be used for a variety of purposes. Some unsecured business loans may even be tailored to meet specific business needs, such as expanding operations or funding large capital projects.

9. Improved Cash Flow Management

For businesses with irregular cash flow or seasonal income, unsecured loans can provide a cushion during lean periods. The ability to access a lump sum of money without waiting for a lengthy approval process can help businesses manage day-to-day expenses, bridge gaps between revenue cycles, and keep operations running smoothly.

10. Simplified Documentation

Unsecured loans typically require less paperwork than secured loans, as there is no collateral to appraise or document. The process focuses more on financial statements, tax returns, and credit history. For small business owners who may not have detailed asset records or who are reluctant to submit extensive paperwork, this simplified process can be a major benefit.

11. Flexible Repayment Terms

While unsecured loans may come with higher interest rates, many lenders offer flexible repayment terms to make it easier for small business owners to manage their loan payments. This may include the ability to choose between different repayment periods, the option to make early repayments without penalties, and the flexibility to adjust payments based on the business’s cash flow.

12. No Need to Sell Equity

Unlike seeking venture capital or angel investment, which often requires giving up equity in the business, unsecured loans do not require business owners to surrender any ownership. This allows entrepreneurs to retain full control over their business while still obtaining the capital they need for growth or emergencies.

13. Opportunity to Build Business Credit

Taking out an unsecured loan and repaying it on time can help small business owners build or improve their business credit score. This can open the door to better financing options in the future, as well as potentially lower interest rates on future loans. Building a strong credit profile can also improve the business’s reputation with lenders and increase the likelihood of loan approval.

Types of Unsecured Loans for Small Businesses

Unsecured loans for small businesses come in various forms, each designed to meet specific financial needs and provide flexible solutions for different types of businesses. Unlike secured loans, which require collateral, unsecured loans are based on the business’s financial health, creditworthiness, and ability to repay. These loans provide quick access to capital without the risk of losing assets. Here’s an overview of the most common types of unsecured loans available to small businesses:

1. Term Loans

Term loans are one of the most straightforward types of unsecured loans for small businesses. These loans provide a lump sum of money that is repaid in fixed installments over a set period (often between one and five years).

Features of Term Loans:

- Fixed Loan Amount: Borrowers receive the full loan amount upfront.

- Fixed Repayment Terms: Repayment is done in regular, fixed installments, which can be weekly, monthly, or quarterly.

- Interest Rates: These loans often come with competitive interest rates, but rates may be higher than secured loans since there is no collateral.

- Flexible Use of Funds: The loan can be used for various purposes, such as working capital, purchasing equipment, or expanding business operations.

Best For: Businesses needing a lump sum for expansion, working capital, or other significant investments.

2. Business Line of Credit

A business line of credit functions like a credit card but for business expenses. It allows businesses to borrow money up to a preset credit limit and only pay interest on the amount of credit used, not the total limit.

Features of Business Lines of Credit:

- Revolving Credit: Once repaid, the credit becomes available again for future borrowing.

- Flexible Borrowing: You can borrow funds as needed and make multiple withdrawals.

- Interest Only on Used Credit: You only pay interest on the balance you owe, not the total credit limit.

- Short-Term Financing: Best for covering short-term needs such as cash flow gaps or emergency expenses.

Best For: Businesses with fluctuating cash flow that need flexible access to funds for everyday operations.

3. Merchant Cash Advances (MCA)

A Merchant Cash Advance is a type of unsecured loan where the lender provides a lump sum in exchange for a percentage of future credit card sales or business revenue.

Features of Merchant Cash Advances:

- Quick and Easy: MCAs are often approved quickly, with minimal documentation required.

- Repayment Tied to Sales: Repayments are made automatically by deducting a percentage of daily or weekly sales, which means payments fluctuate based on business performance.

- Higher Costs: MCAs tend to have high fees and interest rates compared to other unsecured loans.

- Flexible Use: Funds can be used for any business need, from operational costs to business expansion.

Best For: Businesses with consistent credit card sales or revenue streams that need fast access to cash.

4. Invoice Financing

Invoice financing allows businesses to borrow money against their outstanding invoices. This type of loan is ideal for companies that have a lot of outstanding accounts receivable and need funds before their customers pay their invoices.

Features of Invoice Financing:

- Quick Access to Funds: The lender provides a loan based on the value of unpaid invoices.

- Repayment Upon Invoice Payment: Once your customer pays the invoice, the loan is repaid.

- No Collateral: The invoices themselves serve as the “collateral,” so no additional assets are needed.

- Short-Term Financing: Typically used to bridge gaps in cash flow between invoicing and payments.

Best For: Businesses with long invoicing cycles that need cash flow to maintain operations while waiting for payments from clients.

5. Business Credit Cards

Business credit cards are an easily accessible form of unsecured credit that works similarly to personal credit cards. They are widely used for managing business expenses, with the added benefit of offering rewards, cash back, or other incentives.

Features of Business Credit Cards:

- Easy Access: Businesses can apply for a credit card with a credit limit based on their creditworthiness.

- Revolving Credit: Like a line of credit, businesses only pay interest on the balance they carry.

- Rewards and Perks: Many business credit cards offer rewards programs that provide cashback or points for purchases.

- Interest Rates: Interest rates on business credit cards are usually higher than term loans or lines of credit.

Best For: Small businesses that need a convenient way to cover daily business expenses and earn rewards while managing cash flow.

6. Peer-to-Peer (P2P) Loans

Peer-to-peer loans, also known as marketplace loans, involve borrowing funds from individuals (or groups of individuals) through an online lending platform. These loans are typically offered at competitive interest rates and may be a good option for businesses with limited access to traditional financing options.

Features of P2P Loans:

- Direct Lending: Borrowers receive loans from individual investors, bypassing traditional financial institutions.

- Competitive Rates: Interest rates may be lower than those offered by traditional banks, depending on creditworthiness.

- Flexible Terms: Loan terms can vary, with many platforms offering a range of repayment periods and loan amounts.

- Minimal Documentation: P2P platforms may require less documentation compared to banks or other financial institutions.

Best For: Businesses that have a solid credit history but may struggle to get approved by traditional lenders.

7. SBA Microloans

The U.S. Small Business Administration (SBA) offers microloans, which are small, unsecured loans designed to help new and emerging small businesses. These loans are available through approved intermediary lenders and can be used for various business purposes.

Features of SBA Microloans:

- Small Loan Amounts: Typically, microloans range from $500 to $50,000.

- Lower Interest Rates: SBA microloans tend to have lower interest rates than other types of unsecured loans.

- Flexible Use of Funds: The loan can be used for working capital, inventory, supplies, or equipment.

- Business Training: SBA-approved lenders often provide technical assistance and training for small business owners.

Best For: New and small businesses that need small amounts of capital and are looking for lower interest rates and support in managing their business.

8. Crowdfunding Loans

Crowdfunding is a relatively new financing option where businesses raise funds from a large number of individuals, typically through online platforms. In exchange for funding, backers may receive rewards, equity, or a share of future profits.

Features of Crowdfunding Loans:

- No Collateral: Like other unsecured loans, crowdfunding does not require any collateral.

- Public Support: Businesses can tap into the support of their community or other interested parties.

- Variety of Platforms: There are several types of crowdfunding, including reward-based, equity-based, and debt-based (also known as peer-to-peer lending).

- Variable Costs: Crowdfunding platforms usually charge fees, and there might be interest rates or profit-sharing agreements involved.

Best For: Startups and businesses with a compelling story or product that can attract public support and interest.

How to Qualify for Unsecured Loans for Small

Qualifying for unsecured loans for small businesses can be a challenging but achievable process if your business meets the necessary criteria. Unlike secured loans, which require collateral, unsecured loans rely primarily on your business’s financial health, creditworthiness, and overall ability to repay the loan. Below is a detailed guide on the factors that lenders typically evaluate when considering your application for an unsecured loan, as well as tips on how to improve your chances of qualifying.

1. Business Credit Score

A business credit score is one of the most important factors when applying for an unsecured loan. Lenders use this score to assess your company’s creditworthiness and determine the likelihood that you will repay the loan.

How to Improve Your Business Credit Score:

- Pay Bills on Time: Make sure you pay all your business bills, including vendor payments, utility bills, and credit card payments, on time. Late payments can negatively affect your credit score.

- Keep Debt Levels Low: Keep your business debt-to-credit ratio in check. Lenders look for businesses that manage debt responsibly and do not overextend their credit limits.

- Monitor Your Credit Report: Regularly check your business credit report for any errors or inaccuracies. Dispute any incorrect information that may be hurting your score.

Typical Business Credit Score Ranges:

- Excellent: 80-100 (or above)

- Good: 70-79

- Fair: 50-69

- Poor: Below 50

While an excellent business credit score increases your chances of approval and helps secure better loan terms, some lenders may accept lower scores, especially for businesses with strong revenue and growth potential.

2. Personal Credit Score

In some cases, especially for smaller businesses or startups, lenders may also consider the personal credit score of the business owner. This is particularly common when the business has little to no established credit history.

How to Improve Your Personal Credit Score:

- Pay Down Personal Debt: Reducing personal debt (credit card balances, student loans, etc.) can improve your credit score.

- Avoid Late Payments: Consistently paying your personal bills on time, such as your mortgage, car loan, or personal credit card, is crucial.

- Limit Credit Inquiries: Avoid applying for multiple credit cards or loans in a short time, as each inquiry can negatively affect your personal credit score.

A good personal credit score (typically above 680) is often a prerequisite for qualifying for unsecured business loans .

Also Read: Online Personal Loans: Quick And Secure Borrowing Solutions

Conclusion

Unsecured loans for small businesses provide an excellent financing option for entrepreneurs who need quick access to capital without risking their assets. They are ideal for businesses with good credit that need flexibility and speed in securing funding. While they come with higher interest rates compared to secured loans, the benefits—such as fast approval, no collateral requirements, and flexible use of funds—make them an attractive choice for many small business owners.

Before applying for an unsecured loan, it’s important to assess your financial situation, credit score, and ability to repay. By doing so, you can make an informed decision about the best loan option for your business’s needs.

7 FAQs

What is the difference between a secured and unsecured loan for small business?

A secured loan requires collateral, such as property or assets, while an unsecured loan does not. Unsecured loans are based on creditworthiness and financial stability.

Can a startup qualify for an unsecured loan?

Yes, startups can qualify for unsecured loans, but they must demonstrate a solid business plan, positive cash flow projections, and a good credit score.

How quickly can I receive funding with an unsecured loan?

Unsecured loans typically offer fast approval and funding, often within a few days, depending on the lender and loan type.

What are the typical interest rates for unsecured loans?

Interest rates for unsecured loans vary depending on your credit score, financial health, and the lender, but they are generally higher than for secured loans.

Can I use an unsecured loan for any business purpose?

Yes, unsecured loans provide flexibility, and the funds can be used for various business purposes, such as working capital, marketing, equipment, or expansion.

What are the repayment terms for unsecured loans?

Repayment terms for unsecured loans vary depending on the lender and loan type. They may range from a few months to several years.

Are unsecured loans suitable for businesses with bad credit?

Businesses with bad credit may find it more challenging to qualify for unsecured loans, but there are alternative lenders who specialize in working with businesses with lower credit scores.